Why Are Survey Response Rates So Low? (+How to Do It Right in 2026)

Ankur Mandal

Ankur MandalRemember when people actually filled out surveys?

If you've been in marketing for more than a few years, you've watched response rates drop from a respectable 30% in the 1990s to a dismal 12% today.

That's not just a number, it's a crisis that's costing brands real money and real insights.

For example:

- You send a survey to 1,000 customers

- Only 120 respond

- And of those 120, how many genuinely represent your customer base?

- How many just wanted the $10 gift card?

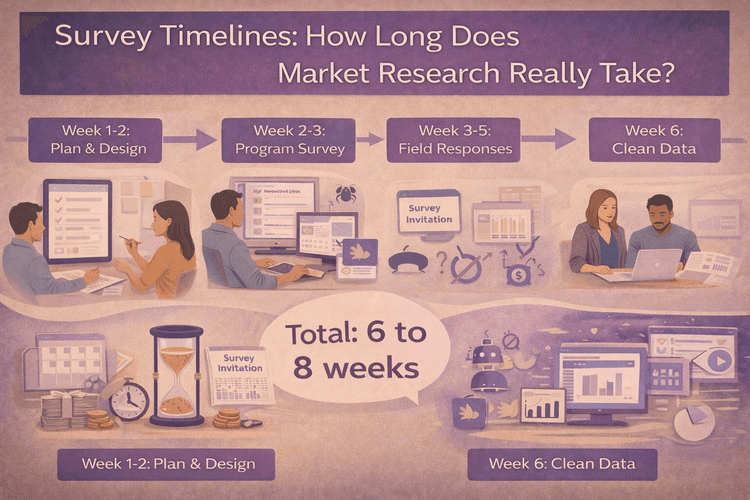

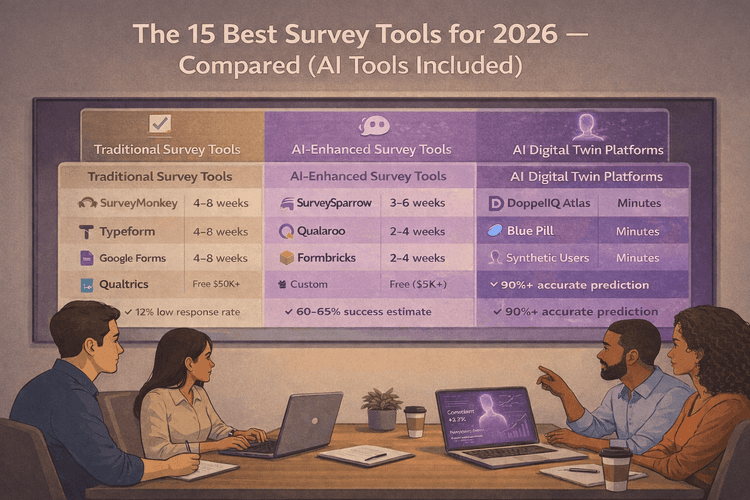

Custom research now costs $25,000–$65,000 per project, takes 4–8 weeks, and by the time results arrive, customer preferences have already shifted.

Consumer tastes change weekly.

Traditional research takes months.

See the problem?

Let’s fix it.

Why nobody wants to take your survey anymore

Think about your own inbox.

How many survey requests did you ignore this week?

Exactly.

Survey fatigue is real

Every interaction ends in a survey request.

- Bought shoes online? Survey.

- Called customer service? Survey.

- Picked up coffee? QR code survey.

We’ve trained consumers to ignore us. They’re not being difficult, just human.

People don't have time (and they know you're taking theirs)

Your customers are juggling work, commuting, kids, and notifications.

A 15-minute survey is asking them to pause their entire day.

Most won’t. And the ones who do?

They often don’t represent your broader customer base.

The hard-to-reach are impossible to reach

Executives, high-income professionals, niche experts, these groups give traditional surveys a near-zero response rate.

These are the customers brands most need to understand, yet they’re the least likely to spare 15 minutes for a $5 Amazon card.

The incentive trap

Rewards boost responses, but introduce incentive bias.

You stop getting thoughtful feedback.

You start getting whatever answers help people reach that gift card the fastest.

People lie on surveys (even when they don’t mean to)

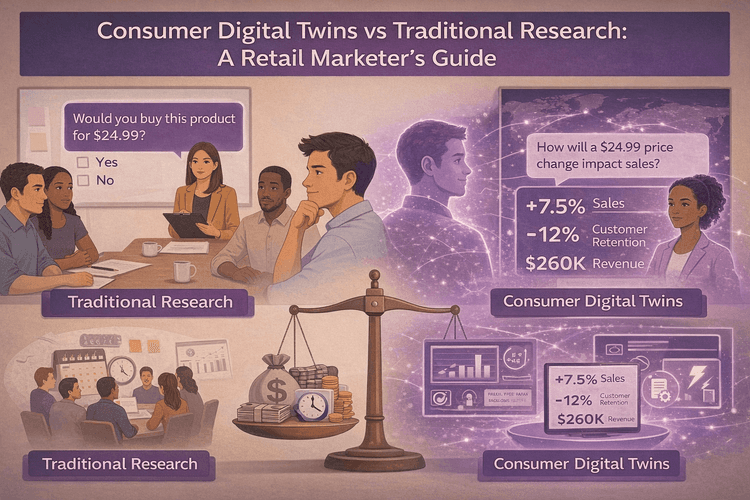

There’s a 40–50% accuracy gap between what people say they will do and what they actually do.

- “I care about sustainability.” → Buys the cheaper item with excessive packaging.

- “I want healthy options.” → Orders the burger and fries.

This isn’t dishonesty, it’s human nature.

People respond based on an idealized version of themselves.

The 2026 playbook for better response rates

Traditional surveys aren’t dead, but you must run them the right way.

Make it mobile-first or don’t bother

Most respondents complete surveys on their phones.

If mobile UX fails, you’ve already lost them.

That means:

- Big buttons

- Minimal typing

- One-screen questions

- Functional progress bars

Keep it short (no, shorter than that)

You think your survey is quick.

Customers think it’s long.

Aim for 5 minutes or less.

Cut every “nice to know” question.

If you can ask it in 3 questions instead of 10, do it.

Personalize like you mean it

"Dear Valued Customer" is outdated.

Use their name.

Reference their last purchase.

Ask only what’s relevant.

Don’t ask someone who’s never bought shoes to rate your shoe selection.

Time it right

Avoid:

- Monday mornings

- Friday afternoons

Check your analytics.

Send surveys when customers actually engage.

Try multiple channels

If email fails, use:

- SMS

- In-app notifications

- QR codes on receipts

- Social media DMs

Meet customers in the channels they prefer.

Be honest about what’s in it for them

Skip corporate lines like “Help us serve you better.”

Instead:

- “Tell us what you think of our new return policy and enter to win $500.”

- “This 3-minute survey helps us stock products you actually want.”

Give them a real reason.

Here's the Thing: These Tactics Help, But They Don't Solve the Real Problem

You can optimize your surveys until they're perfect, mobile-responsive, beautifully designed, perfectly timed, generously incentivized.

You'll still face:

- Low response rates from your most valuable customers

- Weeks of waiting for results

- That stubborn gap between what people say and what they do

- Thousands of dollars per research project

- Data that's outdated by the time you can act on it

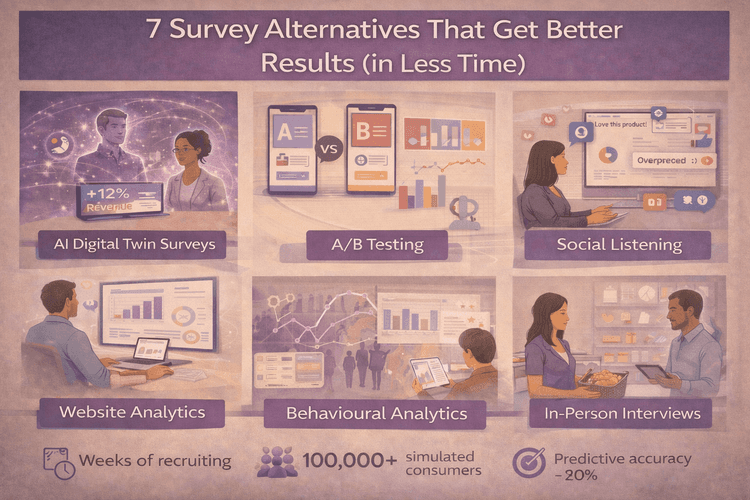

What if the solution isn't better surveys?

What if it's moving beyond surveys entirely?

The good news? There are modern consumer research solutions that address these exact challenges.

Let’s explore the breakthrough approach.

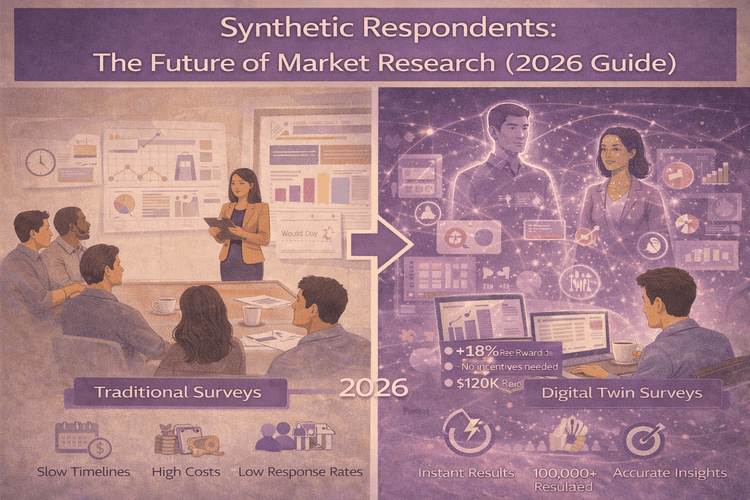

The Future Is Already Here: Population-Scale AI Consumer Digital Twins

Imagine having instant access to 100,000 representative US consumer profiles.

Not generic personas. Not made-up audience segments.

Real behavioral simulations based on actual consumer data.

Now imagine being able to ask these digital twins anything:

- Test any campaign

- Explore any market opportunity

- Validate any product concept

And get answers in minutes instead of weeks.

This isn't science fiction.

This is DoppelIQ Atlas, and it's changing how smart brands understand consumers.

How DoppelIQ Atlas Works (Without the Technical Jargon)

Think of DoppelIQ Atlas like this: Instead of hoping 120 people respond to your survey, you get instant access to a nationwide synthetic panel of 100,000 US consumers.

These aren't AI-generated personas based on guesses. They're population-scale simulations built from real national survey data, behavioral datasets, demographic distributions, psychographics, and professional profiles.

Here's what makes Atlas different:

1. No Data Required From You

Unlike other tools that need months of your customer data to work, Atlas is ready the moment you sign up.

It comes pre-built with:

- 100,000 representative US consumer profiles

- Demographic distributions

- Psychographic patterns

- Professional profiles

- Media and lifestyle signals

2. Ask Questions in Plain English

You don’t need to be a data scientist.

Just type your questions like a conversation:

- “Would young professionals pay more for sustainable coffee pods?”

- “How do suburban families feel about plant-based protein?”

3. Get Instant, Accurate Insights

The digital twins respond based on real behavioral patterns.

You get insights:

- In minutes, not weeks

- With 80% correlation to real US consumer survey outcomes

If you want to understand the full scope of what digital twins can do for market research, check out our complete guide to AI digital twin technology for consumer research.

What Makes Atlas Different from AI Personas

A common misconception:

“Atlas is just another AI persona tool.”

It’s not.

AI personas are pre-built audience archetypes based on assumptions.

Atlas is a population model that simulates real US consumers at scale, grounded in actual national data.

You're not interacting with a handful of fictional personas.

You're interacting with a nationwide synthetic panel of 100,000 real-data-backed consumers, segmented by:

- Demography

- Occupation

- Aspirations

- Behavioral patterns

This is why Atlas achieves 80% accuracy, while traditional AI personas struggle to predict real-world behavior.

Why Atlas Solves the Response Rate Problem

Let’s get practical, here’s what this means for your work:

100% Response Rate, Zero Drop-Off

You want to test messaging across different demographic segments?

With traditional surveys, you'd need to recruit participants, wait for responses, deal with incomplete submissions.

With Atlas, you query 100,000 digital twins instantly. Every one "responds." None of them abandon halfway through. You get complete data on every scenario.

No Incentive Bias

Remember that problem where people rush through surveys to get their gift card? Gone.

Atlas simulates actual consumer behavior and attitudes, not what people think you want to hear. The AI digital twins don't care about incentives. They respond based on real behavioral and psychographic patterns.

This eliminates the 40–50% gap between what people say and what they do.

Results in Minutes, Not Weeks

Traditional survey timeline:

- Day 1–3: Design

- Day 4–7: Approvals

- Day 8–21: Fielding

- Day 22–28: Analysis

- Day 29: Final results (already outdated)

Atlas timeline:

- Minute 1: Sign up

- Minute 5: Ask your first question

- Minute 10: Insights delivered

Access to Everyone, Including the Unreachable

High-income executives who never respond to surveys? Atlas includes them. Busy professionals across every occupation? Their digital twins are ready to respond. Niche segments by region, demography, or occupation?

You can target and query them instantly.

Consistent Testing Across Time

Here's a problem you've probably faced: You run a survey in Q1. Then another in Q3. But the people who responded aren't the same people. So when results differ, is it because preferences changed or because you surveyed different people?

With Atlas, you can query the same population segments repeatedly. This gives you true longitudinal tracking. You know that differences in results reflect actual shifts in consumer attitudes, not sampling variation.

Atlas updates annually based on new US survey benchmarks, so it evolves to stay aligned with current consumer norms while maintaining consistency for your research.

Atlas vs. Traditional Surveys: Side-by-Side Comparison

| Traditional Surveys | DoppelIQ Atlas | |

|---|---|---|

| Response Rate | 12% average | 100% (100,000 twins respond) |

| Time to Results | 4–8 weeks | Minutes |

| Cost Per Study | $25,000–$65,000 | Unlimited queries after signup |

| Sample Size | Limited by budget | 100,000 representative profiles |

| Incentive Bias | High (rewards skew data) | None (behavior-based) |

| Hard-to-Reach Segments | Near-zero response | Full access across all demographics |

| Accuracy | 40–50% say-do gap | 80% correlation with real outcomes |

| Setup Time | Weeks per project | Minutes to first insights |

| Data Requirements | Need respondent recruitment | Zero (pre-built population model) |

Real-World Use Cases: What You Can Do With Atlas

DoppelIQ Atlas isn't just faster research. It's a completely different way to understand consumers. Here's how brands are using it:

Explore New Markets Before You Launch

Test market opportunities across 100,000 twins segmented by demography, occupation, and aspirations. Ask questions like:

- "What is your intent to purchase Nike products in the next 6–12 months?"

- "Which product category is most relevant to you: Lifestyle, Basketball, Running, or Athleisure?"

- "What unmet need exists in the shoe market for you?"

Get instant feedback from suburban families, young professionals, retirees, or any segment you need to understand.

Test Campaigns Without Waiting for Surveys

See how diverse populations react to your messaging before you launch. No more waiting weeks to validate creative concepts.

- Run message testing instantly:

- "Which headline resonates more with millennial parents?"

- "How would Gen Z professionals respond to this sustainability message?"

Spot Emerging Consumer Signals Early

Detect shifts in consumer mindset, preferences, and motivations before they become obvious in your sales data.

Track continuous changes in opinion and cultural sentiment as markets evolve. Stay ahead of trends instead of reacting to them.

Validate Big Product Bets With Confidence

Stress-test new products or categories before you invest in development and launch.

- Measure adoption potential across regions, demographics, or occupations.

- Uncover hidden cultural or occupational biases that could affect acceptance.

- Understand what truly drives people's choices, beyond surface-level data.

Category Pre-Validation

Thinking about entering a new category? Test it first.

Ask Atlas:

- "Would suburban families be interested in a meal kit service focused on Mediterranean cuisine?"

- "How do young professionals perceive electric bikes as a commuting solution?"

Get real directional insights before you commit resources.

Feature Prioritization

Don't guess which features matter most. Ask your target consumers.

- "Which features matter most to US buyers when choosing a fitness app: personalized coaching, community challenges, or nutrition tracking?"

Atlas helps you prioritize development based on actual consumer preferences, not internal assumptions.

The Proof Is in the Numbers

DoppelIQ Atlas has been validated against real consumer research outcomes:

- 80% correlation accuracy: Atlas predictions match actual US consumer survey outcomes 80% of the time.

- 100,000 representative profiles: Not a small sample. A complete synthetic panel of the US consumer population.

- Minutes to insights: Most teams get their first actionable insights within minutes of accessing the platform.

- Zero setup time: No data integration. No IT project. Just sign up and start asking questions.

- Unlimited queries: Unlike traditional research where each study costs $25,000–$65,000, Atlas gives you unlimited access to consumer insights.

When to Use Atlas vs. Traditional Surveys

Atlas isn't a replacement for every type of research. It's a tool for specific situations where speed, scale, and broad market understanding matter most.

Use Atlas when you need to:

- Test concepts or messaging before investing in full campaigns

- Explore new market opportunities quickly

- Understand broad US consumer sentiment across demographics

- Validate product ideas before development

- Run hundreds of quick tests without budget constraints

- Access insights from hard-to-reach consumer segments

- Make fast decisions based on directional consumer insights

Traditional surveys still work well for:

- Deep brand loyalty studies within your specific customer base

- Highly specialized niche markets not represented in US population data

- Situations where you need verbatim quotes from real customers

- Research where your actual customer list must be the sample

The hybrid approach works best:

Use Atlas for rapid exploration and validation. Use traditional research when you need deep, brand-specific insights from your actual customers.

Many brands use Atlas to narrow down concepts quickly, then validate finalists with targeted traditional research. This cuts research costs by 90% while maintaining confidence in decisions.

Getting Started With Atlas Takes Minutes, Not Months

If you're thinking about moving beyond traditional surveys, here's what the Atlas experience actually looks like:

- Data requirements: None. Atlas is pre-built with 100,000 US consumer profiles. You don't provide any data.

- Technical complexity: Zero. Atlas is designed for marketing, insights, product, and strategy teams. No data science or engineering support required.

- Timeline: Sign up and start querying within minutes. Most teams get their first insights before their first coffee break ends.

- Team requirements: Anyone who can ask a question can use Atlas. The platform guides you in real time, suggesting ways to refine questions and target the right segments.

- Who it works for: Any brand that needs to understand US consumer behavior quickly—especially companies exploring new markets, testing concepts frequently, or making fast decisions.

Your First Proof of Value Takes Minutes

For companies just starting with AI digital twins, the fastest way to prove value is to run small, high-impact experiments that mirror real decisions you're facing.

Examples:

- Message testing:

"Which headline resonates more with Gen Z consumers: 'Built for Your Lifestyle' or 'Designed for Real Life'?" - Concept testing:

"How would consumers aged 35–50 respond to a premium grocery delivery service focused on local farms?" - Feature prioritization:

"Which features matter most to remote workers: ergonomic design, portable size, or tech integration?" - Market positioning:

"How do different consumer types perceive the plant-based protein category?"

These produce insights within minutes. And because Atlas simulates behavior at an individual consumer level, you can pinpoint not just what works, but why, and adjust before spending on your product or campaign.

The Real Question Isn't About Response Rates Anymore

We started this article talking about response rates, how they've dropped from 30% to 12%, and how hard it is to get people to take surveys.

But here's the truth: the response rate problem is a symptom of a bigger issue.

Business moves fast. Traditional research moves slow.

Your competitors launch new products weekly. Consumer trends shift in real time. Market opportunities appear and disappear before you can field a single survey.

You wait weeks for 120 respondents. Spend thousands per study. And get biased data from the small percentage who respond.

Population-scale AI digital twins solve the real problem by giving you instant access to representative consumer insights at the speed your business actually moves.

Making the Shift

If you're frustrated with your current research process, you're not alone.

Marketing leaders everywhere face:

- Research that costs too much and takes too long

- Insights that are outdated before you can act

- Survey fatigue destroying response rates

- The gap between what customers say and what they do

- Missed opportunities because research can’t keep up

Atlas fixes this, not by improving surveys, but by replacing waiting with instant access to a nationwide synthetic consumer panel.

The brands that win in 2026 won’t be the ones with better response rates. They’ll be the ones that can test, learn, and adapt faster than everyone else.

Ready to Move Beyond Survey Response Rates?

If you're tired of waiting weeks for survey responses, there's a better way.

DoppelIQ Atlas gives you instant access to 100,000 representative US consumer AI digital twins:

- No surveys

- No waiting

- No incentive bias

Just ask your questions in plain English and get actionable insights in minutes.

Sign up for free and launch your first consumer research test today.

👉 Get Started with DoppelIQ Atlas(Free)

Because the future of consumer research isn’t about getting more people to take surveys.

It’s about having instant access to consumer insights whenever you need them.

Related Articles

How beauty brands use digital customer twins to get insights and win in a competitive segment

Ankur Mandal

Ankur MandalCustomer digital twins vs focus groups vs ChatGPT: Concept testing in market research

Ankur Mandal

Ankur Mandal