Survey timelines: How long does market research really take?

Ankur Mandal

Ankur MandalYou need answers about your customers. Should you launch that new flavor? Will Gen Z actually buy your product? Does your ad message resonate with suburban moms?

So you decide to run a survey. Simple enough, right?

Then reality hits. Your research team says it'll take six weeks. Maybe eight. And that's if everything goes smoothly.

Here's the truth: Traditional market research surveys typically take 4 to 8 weeks from start to finish. For niche audiences or complex studies, you're looking at 10 to 12 weeks or more.

Let's break down why surveys take so long, and more importantly, how modern tools are changing the game completely.

The Traditional Survey Timeline: A Week-by-Week Breakdown

Think of a traditional survey like planning a big dinner party. You can't just send the invite and serve food five minutes later. There's a whole process.

Week 1-2: Planning and Design

First, you need to write your questions. This isn't as easy as it sounds. Every question needs to be clear, unbiased, and actually answer what you're trying to learn.

Your team debates: Should this be multiple choice or open-ended? Are we asking the right things? Do we need to test brand A against brand B, or should we include brand C too?

Then there's the sampling strategy. Who exactly are you surveying? How many people do you need? What demographics matter?

Real-world example: A snack brand wants to test a new chip flavor. They spend two weeks just deciding whether to survey their current customers, potential customers, or both. They debate age ranges, regions, and purchase frequency requirements.

Week 2-3: Programming and Testing

Now someone has to build the actual survey in software. Add the logic (if someone says "no" to question 3, skip to question 7). Test it on different devices. Make sure the skip logic works. Fix the bugs.

This phase usually takes 3 to 5 days if you're lucky.

Week 3-5: Fielding (The Biggest Bottleneck)

Here's where everything slows to a crawl. This is called the "field period" or "survey fielding time," and it's why your market research timeline balloons.

You need to find people who fit your criteria and convince them to take your survey. It's like trying to get 1,000 specific people to show up to your party, except they don't know you and they're busy.

The recruitment nightmare:

-

You need 1,000 responses from "women aged 25-34 who bought athletic shoes in the past 3 months"

-

You send invites to 10,000 people

-

800 people open the email

-

300 people start the survey

-

150 people don't qualify (wrong age, haven't bought shoes recently)

-

50 people quit halfway through

-

You end up with 100 completed surveys

-

Now you need to send more invites and wait another week

For niche audiences, this gets worse. Try finding 500 people who are "male executives in healthcare who influence software purchasing decisions." That could take a month or more.

Week 6: Data Cleaning

Responses are in, but the work isn't done. Someone needs to remove bad data: people who rushed through in 30 seconds, bots, duplicate responses, people who selected the same answer for every question.

This takes another 3 to 5 days.

Week 7-8: Analysis and Reporting

Finally, your research team analyzes the data and creates a presentation. Charts, insights, recommendations.

Total time: 6 to 8 weeks minimum.

What Makes Surveys Take So Long?

The core problem is simple: you're dependent on real people responding on their own schedule.

Think of it like this: Traditional surveys are like waiting for a restaurant table on Saturday night. You put your name on the list, check your phone every few minutes, and hope your table opens up soon. Sometimes you wait 20 minutes. Sometimes it's two hours. You can't control it.

Other factors that extend your market research timeline:

-

Low response rates: Only 10-30% of people you contact actually complete your survey

-

Sequential testing: Want to test five different audience segments? You often have to run them one after another

-

Last-minute changes: Your boss wants to add two questions after fielding starts? That might mean starting over

-

Quality issues: Bad responses mean you need more data, extending the field period

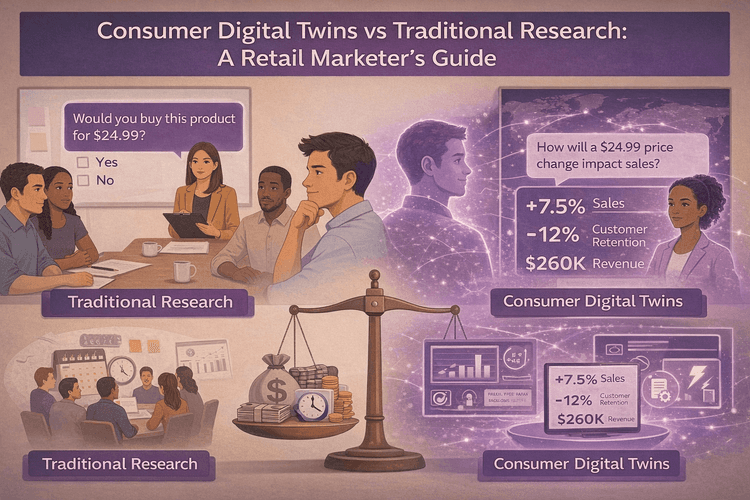

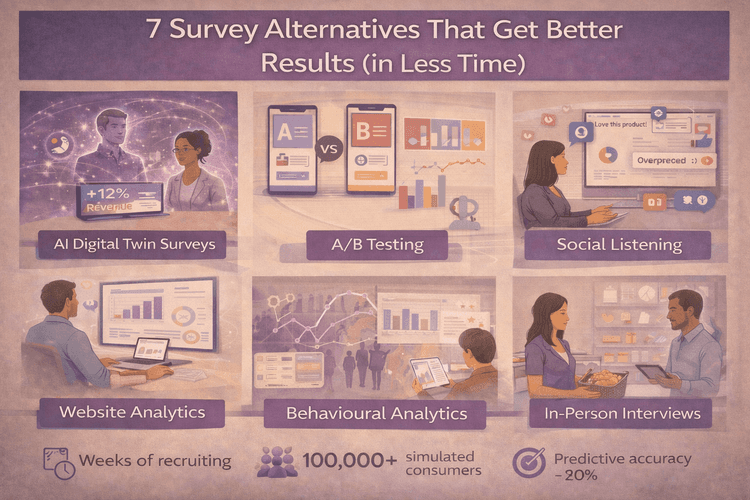

The New Reality: AI Digital Twin Surveys

Now imagine a different scenario. What if you could survey 10,000 people and get results before your coffee gets cold?

That's what AI Consumer Digital Twins make possible.

Here's how it works: Instead of waiting for real people to respond, you survey behaviorally accurate AI versions of real consumers. These aren't just chatbots making stuff up. They're built from actual survey data, behavioral patterns, demographics, and psychographics from 100,000 representative US consumers.

DoppelIQ Atlas is one such platform. It's like having a room full of 100,000 diverse Americans who are always available to answer your questions instantly.

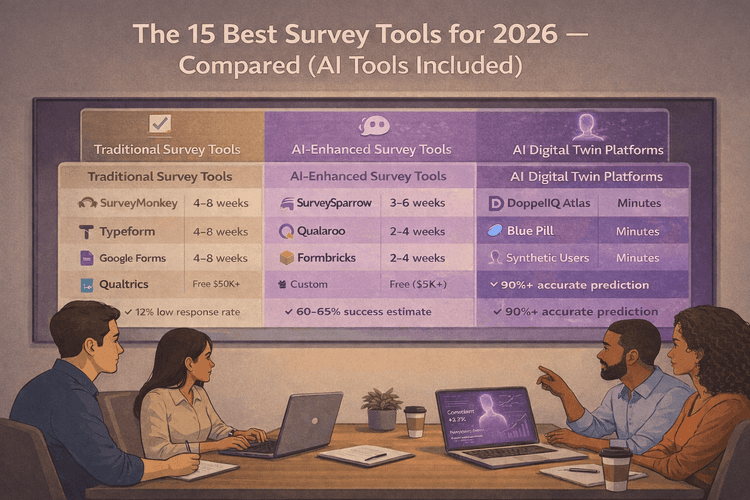

Timeline Comparison: Traditional vs. AI Digital Twins

Let's look at how the same research project plays out with both approaches:

| Research Phase | Traditional Survey | DoppelIQ Atlas |

|---|---|---|

| Planning & Design | 1–2 weeks | Minutes (type your question in plain English) |

| Survey Programming | 3–5 days | Not needed (natural language interface) |

| Sample Recruitment | 3–7 days | Instant (100,000 profiles ready) |

| Fielding 1,000 responses | 1–3 weeks | Minutes |

| Fielding 10,000 responses | 3–6 weeks | Minutes |

| Data Cleaning | 3–5 days | Automatic (real-time) |

| Ready for Analysis | 4–8 weeks total | Minutes total |

| Testing Multiple Segments | Sequential (multiply time by number of segments) | Simultaneous (test 10 segments at once) |

| Making Changes & Re-testing | Add 2–3 weeks | Instant (zero lead time) |

Real Project Example:

You want to test a new product concept with 5,000 consumers across 5 different age groups.

-

Traditional Survey: 5-6 weeks (and that's if everything goes smoothly)

-

DoppelIQ Atlas: 15-20 minutes

Three Game-Changing Advantages

1. Zero Recruitment Delays

Remember that nightmare of finding qualified respondents? Gone. Digital Twins don't need to be recruited, screened, or convinced to participate. They're already there, representing the full spectrum of US consumers.

2. Test Multiple Audiences Simultaneously

Want to see how your product idea plays with teenagers, young professionals, and retirees at the same time? With traditional surveys, you'd often run these sequentially (adding weeks to your timeline). With Digital Twins, you test all three groups at once.

Example: A coffee brand wants to test a new sustainable packaging message across 10 different demographic segments. Traditional approach: 8-10 weeks. DoppelIQ Atlas: 20 minutes.

3. Instant Iterations

Your first results show the messaging isn't quite right. In traditional research, making changes and re-fielding means adding another 2-3 weeks. With Digital Twins, you tweak your approach and test again immediately.

It's like the difference between texting (instant response) and mailing letters (wait for days).

When Speed Really Matters

Quick survey turnaround time isn't just nice to have. In retail and marketing, speed can mean the difference between winning and losing:

-

Campaign testing: Your ad is scheduled to launch in two weeks. Can you test three different messages and pick the winner? With traditional surveys, probably not. With Digital Twins, easily.

-

Competitive response: A competitor just launched a new product. You need to understand consumer reaction before you finalize your counter-strategy. Waiting 6 weeks isn't an option.

-

Product development: You're deciding between three product features. Traditional research means picking one and hoping you're right. Digital Twins let you test all three and iterate based on real insights.

The Accuracy Question

You might be thinking: "This sounds great, but are AI responses actually accurate?"

DoppelIQ Atlas shows 83% correlation with real US consumer survey outcomes. That's because these Digital Twins aren't making random guesses. They're built on actual survey data, real behavioral patterns, and demographic distributions that mirror the US population.

Think of it like a weather forecast. It's not going to be 100% perfect every time, but it's accurate enough to help you make smart decisions. And you get the forecast instantly instead of waiting two months.

For a deeper comparison of different consumer research solutions and their accuracy, check out this comprehensive platform comparison.

Getting Started Takes Minutes, Not Weeks

Here's what the onboarding process looks like with DoppelIQ Atlas:

-

Sign up (takes 2 minutes)

-

Select your target audience (or test multiple audiences)

-

Type your question in plain English

-

Get your results

No research degree required. No data science team needed. If you can ask a question in a normal conversation, you can use the platform.

Most teams like marketing, growth, insights teams, research teams and so on get their first actionable insights within minutes of accessing the platform.

Frequently Asked Questions

How long does it take to get survey results?

Traditional surveys take 4 to 8 weeks from start to finish. AI Digital Twin platforms like DoppelIQ Atlas deliver results in minutes.

What is survey fielding time?

Survey fielding time is when your survey is actively collecting responses from people. This usually takes 1 to 6 weeks and is the longest part of traditional research.

Why do surveys take so long?

The main bottleneck is waiting for real people to respond. Between recruitment delays, low response rates (only 10-30% finish), and data cleaning, weeks add up quickly.

How long does a 1,000 person survey take?

Traditional surveys need 3 to 5 weeks for 1,000 completed responses. With AI Digital Twins, the same survey completes in minutes.

Can you speed up survey response times?

With traditional methods, you can offer incentives or use panels, but you're still waiting on people's schedules. AI Digital Twin technology eliminates waiting time completely.

How long does market research take for a new product?

Traditional product research takes 6 to 12 weeks for concept testing and validation. Digital Twin technology can complete the same research in days instead of months.

What's the difference between survey fielding time and total project time?

Fielding time is just data collection (1-6 weeks). Total project time includes planning, programming, fielding, cleaning, and analysis (4-8 weeks total).

Are AI survey results accurate?

Yes. DoppelIQ Atlas shows 83% correlation with real consumer surveys because Digital Twins are trained on actual survey data and behavioral patterns, not random guesses.

The Bottom Line

Traditional surveys taking 4 to 8 weeks isn't anyone's fault. That's just how long it takes when you're dependent on recruiting real people and waiting for responses.

But in 2025, you have options. The survey completion time that used to be measured in weeks can now be measured in minutes.

The question isn't whether AI Digital Twins will replace some traditional research. They already are. The question is whether you'll adopt this technology before your competitors do.

Because while you're waiting 6 weeks for survey results, someone else is testing, learning, and adjusting in real time.

Ready to See the Difference?

Try DoppelIQ Atlas free and run your first survey in minutes. No credit card required. No long onboarding process. Just sign up and start getting the consumer insights you need at the speed your business demands.

Stop waiting weeks for answers. Start getting insights in minutes.

Related Articles

How beauty brands use digital customer twins to get insights and win in a competitive segment

Ankur Mandal

Ankur MandalCustomer digital twins vs focus groups vs ChatGPT: Concept testing in market research

Ankur Mandal

Ankur Mandal