Digital Twin of a Customer: How It Revolutionizes Consumer Research

Ankur Mandal

Ankur MandalPicture this: Your competitor launches a pricing campaign that captures 10% market share overnight. By the time your quarterly consumer research delivers insights on "optimal pricing strategies," the opportunity has vanished, and you're left explaining to leadership why your $40,000 market study arrived three months too late.

This scenario plays out daily across retail, e-commerce, and CPG companies. While businesses sprint at digital speed, traditional consumer research crawls at the pace of focus groups and survey panels. The gap between when consumer behavior shifts and when insights arrive has become a silent profit killer.

Digital twin technology changes this equation entirely.

What is a digital twin for customers (DToC)?

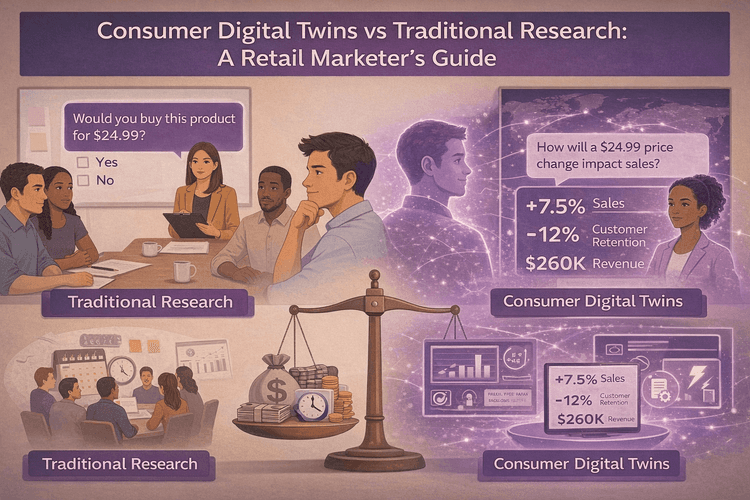

A digital twin is a virtual replica of your consumers. With these digital twins, instead of waiting weeks for consumer survey results or focus group insights, marketing teams can instantly test how consumers will react to pricing changes, new messaging, or product features before spending a dollar on media.

Think beyond static research reports. Digital twins simulate real consumer decisions: "How will our audience respond to a 20% discount?" or "Which product positioning drives higher conversion?" You get research-quality insights in minutes, not months.

How does a digital twin simulation work to give customer insights?

Consumer digital twins operate through four interconnected layers that transform raw data into actionable predictions.

-

Data connection layer: The foundation connects to your existing data ecosystem through plug-and-play connectors. The system continuously pulls information from your CRM, e-commerce platform, CDPs (Customer Data Platforms), email campaigns, and customer service interactions. Unlike traditional research that requires fresh data collection for each study, digital twins activate your existing first-party data without additional collection efforts.

-

Digital twin creation layer: This layer builds behaviorally accurate simulations of real customer cohorts. The system doesn't just create static profiles—it constructs evolving digital replicas that mirror individual customer behavior, purchase patterns, brand affinities, preferences, and decision-making processes. These aren't simplified personas, but comprehensive behavioral models that can be queried, segmented, and experimented with."Most brands think they know their customers through dashboards and metrics, but what they really need is to understand the 'why' behind every decision," explains Mohd Azam, CEO and co-founder of DoppelIQ. "Our digital twin technology doesn't just predict behavior—it simulates the actual thought process that leads to purchase decisions."

-

Digital twin interaction layer: Marketing teams can ask questions, run tests, and experiment with specific customer segments using natural language queries. Instead of writing complex queries or waiting for data analysts, team members can ask "How would our customers react to a 20% price increase?" and receive detailed, segment-specific simulations of customer responses.

-

Insights delivery layer: GenAI distills raw twin responses into crisp, actionable insights ready for immediate use. The system translates complex behavioral simulations into clear recommendations for marketing campaigns, product launches, pricing strategies, or CRM activation.

Continuous evolution: As new real-time data flows through the ingestion layer, the digital twins automatically update and evolve, ensuring simulations reflect current customer behavior rather than historical snapshots.

The result is a system that can simulate how thousands of individual customers will respond to specific business decisions, delivering insights in minutes rather than months.

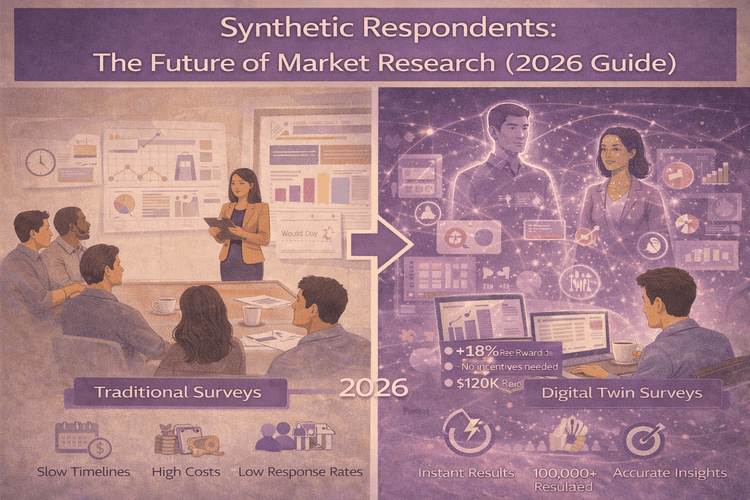

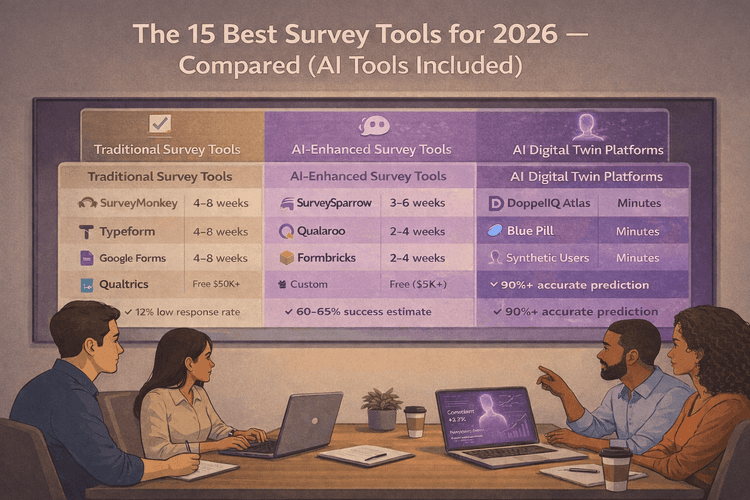

Why customer digital twins are replacing traditional research methods

The consumer research industry faces three crisis points that digital twins directly address - delay in insights, survey fatigue & accuracy challenges, and dollars spent on traditional surveys and focus groups.

| Digital Twins | Traditional Research | |

|---|---|---|

| Speed | Minutes to insights | 4–8 weeks delivery |

| Cost | 90% cheaper per insight after setup | $25K–$65K per project |

| Frequency | 365 days unlimited interviews and surveys, post setup | 1 market research project per quarter |

| Data Quality | 80%+ prediction accuracy | 12% survey response rates + 38% data quality issues (Kantar) |

| Customer Understanding | Evolving customer simulation | Static demographics |

| Scalability | Unlimited scenario testing after initial setup | Limited by sample recruitment |

By the time insights arrive, trends have moved on

Consumer sentiment shifts continuously. Social media trends change overnight. Viral content reshapes preferences within days. Yet traditional research operates on quarterly cycles, creating a fundamental mismatch between insight delivery and market reality.

The gap between research completion and implementation means insights are stale before application. Consumer attitudes measured in January may not reflect February behaviors, particularly in dynamic categories like technology, beauty, or food trends where viral moments drive rapid preference shifts.

According to the Nielsen Norman Group, 46% of brands update their personas only once every 1-4 years, despite consumer behavior evolving continuously. This creates a dangerous lag between customer reality and business understanding.

A beauty brand experienced this when TikTok trends shifted consumer interest toward specific skincare ingredients. Their two-month research study delivered insights about ingredients that had already peaked in social conversation, while agile competitors captured the entire trend

Survey fatigue has created a data quality crisis

Survey response rates continue plummeting as consumers face daily requests to "share feedback" from every brand interaction. This has created a vicious cycle: lower response rates lead to less representative samples, which leads to poor data quality, which leads to business decisions based on flawed insights.

The problem runs deeper than low participation. According to The State of Online Research Panels by Kantar, surveys and panels suffer from poor responses, fraudulent data, and "overly helpful" responses that skew results.

The data quality crisis by the numbers:

-

38% of data discarded: In Q4 2022, researchers discarded up to 38% of collected data due to quality concerns and panel fraud

-

70% rejection rates: One recent case required returning 70% of data from a leading panel provider due to unusable quality

-

Pandemic fraud boom: Panel fraud exploded during COVID-19 and continues growing exponentially

The three types of bad actors Kantar research firm identified:

-

The Lazy Panelist: Misreads questions, provides inconsistent answers

-

The Dishonest Panelist: Lies to receive rewards, inflates responses

-

The Fraudulent Panelist: Completely fabricated identity and responses

These bad actors impact data at varying levels, causing poor-quality behavior and overall damage to data integrity. The result: expensive research projects delivering insights based on fundamentally flawed data.

Focus groups face similar challenges with mounting recruitment difficulties and costs ranging from $150 to $625 per participant. The economics become particularly challenging for niche audiences or specialized demographics.

In our recent conversation with a founder of a DTC brand, he shared their experience: "Despite offering incentives and follow-up reminders, our survey achieved just 12% response rate. The resulting insights, based on a small, potentially biased sample, led to product positioning changes that failed to resonate with the broader consumer base."

The cost of research is crushing marketing budgets

According to The Farnsworth Group's 2025 market research cost analysis, a custom market research project costs between $25,000 to $65,000 and takes 4-8 weeks to complete. For businesses needing quarterly insights across multiple product lines or market segments, research costs quickly escalate into six figures annually.

The hidden cost isn't just the upfront expense—it's the opportunity cost of delayed decisions. While you wait for research completion, competitors launch campaigns, adjust pricing, and capture market share. Every week of delay potentially represents lost revenue that far exceeds the research investment itself.

The true cost breakdown:

-

Short quantitative surveys: $15,000-$30,000 (primarily validate existing hypotheses)

-

Custom qualitative/quantitative studies: $25,000-$65,000 (full market insights)

-

Specialist industry research: Higher end of range due to expertise required

-

Annual research programs: Often exceed $200,000+ for comprehensive coverage

For many mid-market companies, this means choosing between comprehensive research and other critical marketing investments. The result: either flying blind with limited insights or spending a disproportionate budget on research that arrives too late to influence key decisions.

Consider a fashion retailer preparing for spring launches. Traditional research conducted in January costs $40,000 and delivers insights in March—after trend-setting competitors have already captured early adopter customers and established market positioning.

The economics become even more challenging when you factor in internal costs: project management time, data cleaning, analysis, and the iterative process of clarifying ambiguous results. What appears as a $40,000 research project often costs $60,000+ in total organizational investment.

Four key areas where business leaders win with digital twins

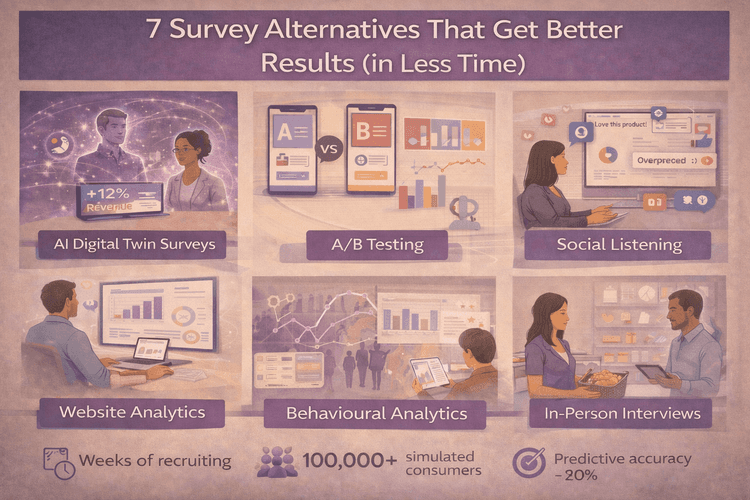

Digital twins excel in scenarios requiring rapid hypothesis testing and scenario modeling.

-

Campaign testing transforms how brands approach messaging development. Instead of creative testing through expensive focus groups or A/B testing live campaigns, marketing teams can ask: "How will you react to this messaging/creative?" The system provides detailed response predictions by consumer segment, including emotional reactions, purchase intent, and competitive positioning.

-

Pricing optimization becomes dynamic rather than static. Teams can query: "What's the optimal discount level for each consumer?" and receive revenue-maximizing price points based on individual price sensitivity modeling. This enables personalized pricing strategies that maximize both conversion and margin.

-

Product development gains consumer input before development costs are incurred. Questions like "Which headphone feature should we prioritize?" generate consumer preference rankings that guide roadmap decisions. This reduces the risk of building features consumers don't value while identifying unexpected opportunities.

-

Market entry decisions benefit from risk assessment without market exposure. "How will this new product category perform?" generates sales forecasts based on individual consumer likelihood to adopt, providing individual consumer confidence levels for investment decisions.

These applications share a common thread: they enable testing before committing resources, reducing risk while increasing decision speed.

Ready to transform your consumer research approach? Discover how leading brands are using digital twins to gain competitive advantages through instant consumer insights.

How to get started with consumer digital twins

The barrier to entry for consumer digital twins is lower than most business leaders expect.

You already have the foundation

Most businesses possess sufficient data to begin digital twin modeling without additional collection efforts. Your CRM and CDPs contain purchase history and consumer interactions. Your e-commerce platform tracks browsing behavior and conversion patterns. Email systems record engagement preferences and response rates.

The minimum requirement is just a few months of transaction and interaction data. The minimum requirement is just a few months of transaction and interaction data. DoppelIQ's proprietary approach uses intelligent inference modeling and machine learning to fill gaps in incomplete datasets through direct fields, inferred data, and ML enrichment—meaning perfect data isn't required to start generating insights.

Integration happens through pre-built connectors rather than complex technical implementations. Shopify, Salesforce, and major CDP platforms connect through pre-built API connectors that require minimal IT involvement.

Perhaps most importantly, the technology is designed for marketing, research, and insights teams. Natural language querying means team members can start asking questions immediately without learning new software or statistical methods.

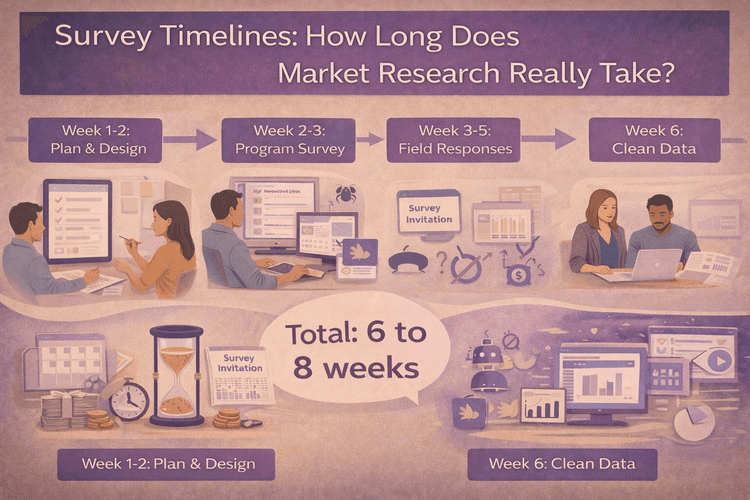

Implementation follows a predictable four-week timeline

Week 1: Data mapping & integration (Connect) - Automated mapping identifies available consumer information across your existing systems. Pre-built connectors link to common platforms without custom integration work.

Weeks 2-3: Digital twin configuration and creation (Processing) - The system automatically enhances data quality, fills gaps through intelligent inference, and builds consumer digital twins. Validation against historical data ensures accuracy before deployment.

Week 4: First insights delivered (Launch) - Marketing teams can ask questions, run tests, and ideate with specific customers in natural language and gain immediate capability to test campaigns, pricing, and messaging decisions.**

Month 2+: Continuous optimization (Scale) - Real-time data updates keep twins current without manual intervention. Continuous learning improves accuracy over time as predictions are validated against actual consumer behavior.

Success comes quickly

Most teams run successful campaigns based on digital twin insights within their first month of implementation. The combination of immediate insight availability and high prediction accuracy (80%+ validated against real outcomes) creates confidence in decision-making that translates directly to business results.

The technology complements existing research rather than replacing it entirely. Digital twins excel at rapid hypothesis testing and scenario modeling, while traditional research remains valuable for deep qualitative exploration and brand perception studies. Additionally, market research results can be integrated into the digital twin platform, further improving its accuracy and real-world correlation.

Curious about implementation specifics for your business? Learn how digital twin platforms integrate with your existing marketing technology stack.

Frequently asked questions

What role does AI play in consumer digital twins?

DoppelIQ’s AI powers the consumer digital twins by creating behavioral simulations of real customers using machine learning and data enhancement techniques. This enables brands to predict customer responses before launching campaigns or products.

How do large language models enhance digital twin accuracy?

Large language models enhance digital twin accuracy by enabling natural language interactions with customer simulations, providing real-time guidance for better questioning, and generating individual-level behavioral responses rather than generic averages.

How is a consumer digital twin different from AI chatbots like ChatGPT?

Consumer digital twins are purpose-built behavioral simulation platforms that model individual consumers based on real data, while AI chatbots provide generic responses. Digital twins can simulate thousands of consumers' reactions to specific business scenarios with measurable accuracy (80%+), enabling pre-launch testing and scenario planning.

What data do I need to create accurate consumer digital twins?

You can start with as little as a few months of transaction data, consumer records, and basic behavioral information. The platform uses machine learning (ML) to fill gaps and infer missing data points through direct fields, inferred data, and ML enrichment—perfect datasets aren't required.

How quickly can we get insights compared to traditional research methods?

After initial setup (typically 4 weeks), digital twins generate insights in minutes instead of the 4-8 weeks required for traditional market research. This enables real-time campaign testing, pricing decisions, and product choices without delays.

Can our marketing team use this without data science expertise?

Yes, modern consumer digital twin platforms use natural language interfaces that allow marketing teams to ask questions conversationally, just like conducting consumer interviews. No coding or statistical background is required—teams can query "How would consumers react to a 20% discount?" and get immediate, detailed responses.

How accurate are digital twin predictions compared to surveys and focus groups?

Well-implemented consumer digital twins achieve 80%+ accuracy when validated against historical data and real-world outcomes. This matches or exceeds traditional methods while delivering results instantly and without the bias issues that plague surveys (response bias, sample representativeness, survey fatigue).

What's the cost comparison to traditional market research?

While platform costs vary, digital twins eliminate the $25K-$65K per-project costs of traditional research. After initial setup, digital twins reduce research costs by 90%, and you can run unlimited scenarios. Many companies see ROI within the first quarter through improved campaign performance and faster decision-making.

To conclude

The shift from traditional consumer research to digital twin technology isn't just about speed or cost—it's about competitive advantage. While your competitors wait weeks for research insights, you can test hypotheses, validate strategies, and launch campaigns with confidence.

The question isn't whether digital twins will become standard practice in consumer research. Early adopters are already using them to capture market opportunities that traditional research timelines would miss entirely.

Ready to join forward-thinking brands using digital twin technology for instant consumer research? Discover how your business can implement consumer digital twins in just four weeks and start making data-driven decisions at the speed of modern commerce.

Footnotes

Related Articles

How beauty brands use digital customer twins to get insights and win in a competitive segment

Ankur Mandal

Ankur MandalCustomer digital twins vs focus groups vs ChatGPT: Concept testing in market research

Ankur Mandal

Ankur Mandal