Consumer Digital Twins vs Traditional Research: A Retail Marketer's Guide

Ankur Mandal

Ankur MandalNetflix doesn't ask you to fill out surveys about what you want to watch. It watches what you actually watch and predicts what you'll love next. Spotify creates your perfect playlist without asking you 47 questions about your music preferences. It learns from your actual listening behavior.

The entertainment industry cracked the code: predicting behavioral patterns beats surveys, every time.

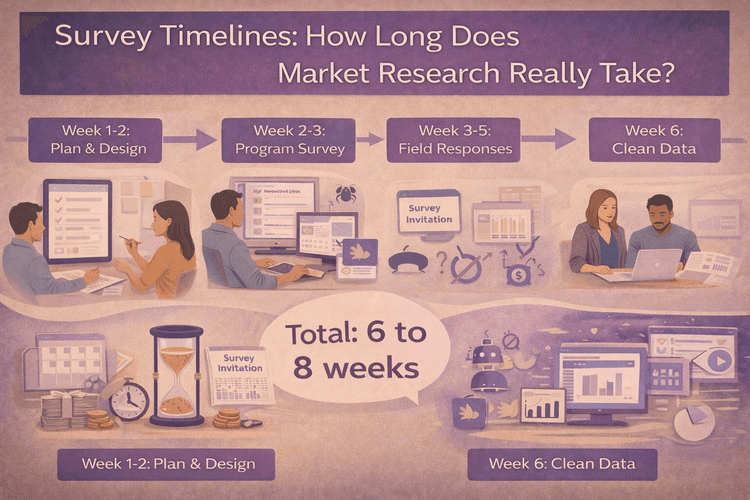

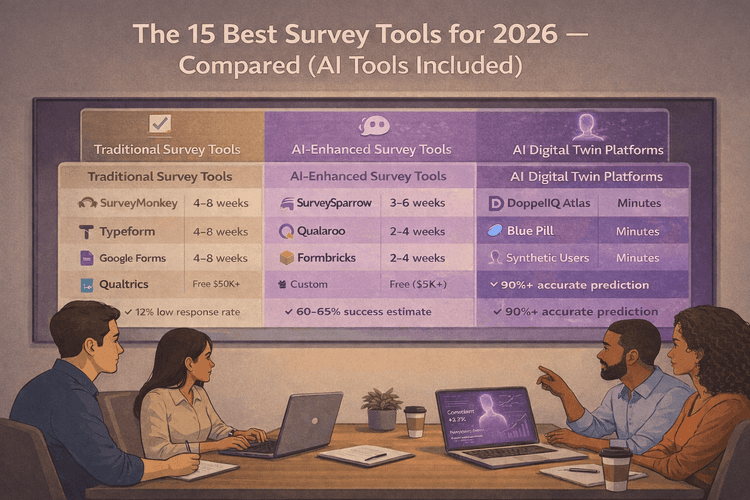

Retail teams, however, are so far working within systems built around surveys and focus groups, asking customers what they might buy next quarter, waiting 6-8 weeks for responses from the 12% who respond, then making critical inventory and pricing decisions based on stated intentions rather than actual behavior.

Traditional market research excels at telling you what happened, but struggles with predicting what will happen. The gap between customer intentions and actions creates real business risk.

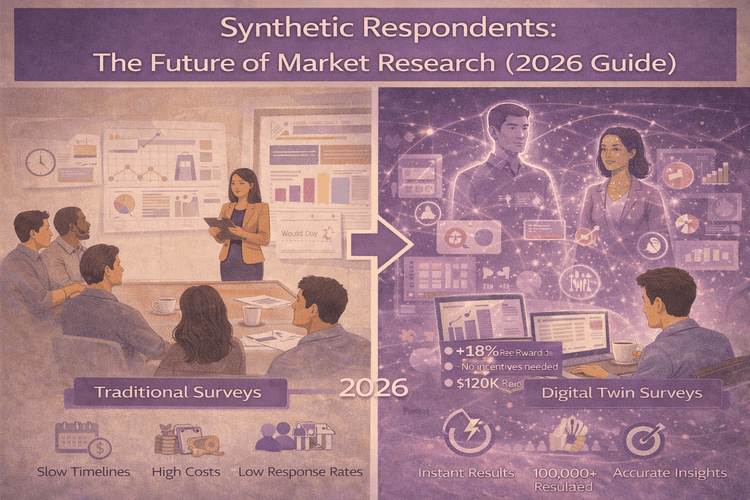

Consumer Digital Twins change this dynamic entirely, simulating actual customer behavior to predict real purchasing decisions, just like Netflix predicts your next binge-watch.

Frustrations with traditional research so far

-

The speed problem: Business moves at the speed of social media, but research moves at the speed of academia. When competitors pivot pricing or launch campaigns, you're stuck waiting weeks for insights that arrive after the opportunity has passed.

-

The cost spiral: Traditional research budgets have become black holes. Between $150K-$300K annually just to stay current, yet you're still making decisions with outdated information and limited testing scenarios.

-

The sample reality: Low response rates mean you're hearing from the extremes - your biggest fans and harshest critics - while the majority of customers who drive your revenue remain silent. That's not market research; that's noise amplification.

-

The timing mismatch: Research cycles and business cycles are fundamentally misaligned. By the time you get summer insights, fall planning has already begun. You're perpetually one season behind.

-

The say vs. do gap: Customers are terrible predictors of their own behavior. Focus groups love premium features until they see the price tag. Survey respondents claim they'll switch brands for sustainability until convenience wins on shopping day.

-

The testing limitations: Budget constraints force you to test only your best guesses instead of exploring the full range of possibilities. You're leaving money on the table because you can't afford to find it.

Why digital twins are better suited for modern requirements

Consumer Digital Twins work like the recommendation engines you use every day as a consumer, but for your customers' buying behavior.

Instead of asking customers what they might do, Digital Twins simulate what they will do based on how they actually behave.

Here's how they solve the core problems retail marketers face:

-

Speed that matches business reality: Test pricing changes in minutes, not months. When your competitor makes a move, you can model customer response before your morning coffee gets cold.

-

Unlimited testing without the cost: Run 50 different pricing scenarios for the same cost as one traditional focus group. Test every holiday campaign variation you can imagine.

-

Your entire customer base, not just survey respondents: Instead of hearing from 200 people with strong opinions, simulate behavior across all your customers using their actual purchase history.

-

Behavior, not intentions: Predict what customers will actually buy based on what they've actually bought, not what they tell you they might consider purchasing.

-

Real-time adaptation: Consumer preferences shift weekly. Digital Twins let you test and adapt at the same speed, rather than waiting for quarterly research cycles.

How do digital twins compare to traditional research on the metrics that matter?

| What matters most | Traditional research | Digital twins | Real-world impact |

|---|---|---|---|

| Speed to answers | 4–8 weeks from question to actionable insight | Minutes for pricing tests, hours for campaign optimization | Competitor drops prices Friday → Traditional: respond next quarter vs Digital Twins: test responses over weekend, launch Monday |

| Annual research cost | $25K–$65K per study × 4–6 studies = $150K–$300K yearly | $10K–$60K for unlimited qualitative and quantitative studies | Test 50 holiday pricing strategies for less than one traditional pricing study |

| Testing capacity | 2–3 variations per study due to cost/time constraints | 500+ scenarios possible | Instead of guessing between $19.99 or $24.99, test every dollar increment to find the sweet spot at $22.99 |

| Prediction accuracy | 40–50% gap between what customers say vs. actually do | 80%+ accuracy predicting real purchase behavior | Avoid "focus group loved it, customers didn’t buy it" disasters |

| When results arrive | Plan study → wait 8 weeks → market has moved on | Question arises → test immediately → decide with confidence | Test summer strategies in March vs. getting summer insights in May when it’s too late |

| Who you learn from | 12% response rates from people with strong opinions and free time | 100% of customer base through behavioral data | Make inventory decisions based on all customers, not just survey completers |

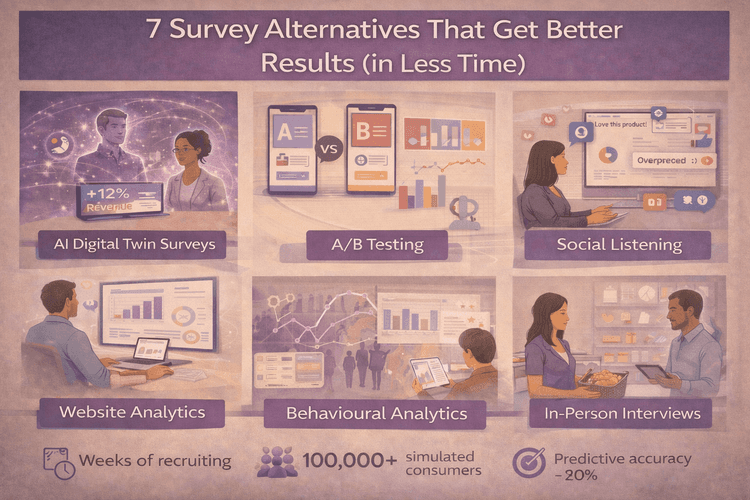

How traditional research and digital twins work better together

Here's the thing: traditional research and digital twins are not competitors. They're different tools for different jobs, like having both a GPS and a map in your car.

When should I still use traditional research?

Best for: Understanding the "why" behind customer motivations, exploring new categories, and mapping brand perceptions.

Perfect use cases:

-

Annual brand health studies to understand how customer attitudes are shifting

-

Exploring completely new product categories where you need to understand customer needs

-

Understanding emotional drivers behind purchase decisions

-

Researching demographic segments you don't currently serve

Timeline: Quarterly or twice-yearly deep dives that inform long-term strategy.

Real example: Your annual brand study reveals that sustainability is becoming important to your core customers. That's strategic gold.

When should I use digital twins instead?

**Best for:** Predicting the "what" of customer behavior for daily business decisions.

Perfect use cases:

-

Daily pricing decisions and promotional planning

-

Campaign message testing and optimization

-

Inventory planning and product mix decisions

-

Competitive response strategies

Timeline: Real-time, ongoing decision support that keeps pace with business needs.

Real example: Now that you know sustainability matters, test 15 different sustainable product messages to see which ones actually drive purchases and at what price points.

How do they work better together?

Traditional research tells you sustainability is important. Digital Twins tell you that "locally sourced" messaging drives 23% more purchases than "carbon neutral" messaging, but only at price points under $35.

Traditional research reveals that customers shop differently during economic uncertainty. Digital Twins let you test 20 different recession-friendly pricing strategies to find the ones that maintain volume.

Traditional research maps the customer journey and identifies pain points. Digital Twins predict which specific fixes will have the biggest impact on conversion rates.

What's the right tool for each decision?

Think of it like cooking. Traditional research is like understanding that your customers love Italian food. Digital Twins help you predict whether they'll order the $18 pasta or the $24 pasta on a Tuesday night in November.

For long-term strategy and brand positioning: Traditional research provides the depth and context you need.

For daily operational decisions: Digital Twins provide the speed and precision that keeps you competitive.

For exploring new markets: Traditional research maps unknown territory.

For optimizing known markets: Digital Twins maximize performance.

Can digital twins make my traditional research better?

Digital Twins can actually make your traditional research more effective and less expensive:

-

Test concepts quickly before investing in expensive focus groups

-

Validate survey findings against behavioral predictions to catch disconnects early

-

Focus traditional research on the highest-impact questions instead of testing everything

Stop guessing and start predicting!

Your customers are already telling you everything you need to know through their actual behavior. The question is whether you're listening to the right signals.

Stop waiting 8 weeks for research that's outdated before it arrives. Stop making million-dollar decisions based on the 12% who respond to surveys. Stop watching competitors move faster while you're stuck in research cycles.

See how consumer digital twins work for your business. Test your next pricing decision, campaign strategy, or product launch before you risk real revenue. Get the predictive power of Netflix's recommendation engine for your customer behavior.

Ready to explore your options? Check out our comprehensive guide to the best consumer research solutions in 2025 to see how digital twins compare to other modern research approaches.

Schedule a demo with DoppelIQ to see how brands are already using Digital Twins to predict customer behavior with 80%+ accuracy, test unlimited scenarios in minutes, and make decisions with confidence instead of guesswork.

The retail prediction revolution is here. Your choice is simple: lead it or follow it.

Related Articles

How beauty brands use digital customer twins to get insights and win in a competitive segment

Ankur Mandal

Ankur MandalCustomer digital twins vs focus groups vs ChatGPT: Concept testing in market research

Ankur Mandal

Ankur Mandal