Instant Consumer Insights: Why Waiting Weeks for Surveys Is Over

Nehan Mumtaz

Nehan MumtazYour competitor just dropped a new product line. You need to know how your customers will react so you can adjust your strategy. You send out a survey request. Then you wait. Three weeks later, the data comes back. By then, your competitor has already captured market share, and you're playing catch-up.

This scenario plays out every day in retail and consumer brands. The gap between needing answers and getting them has always been part of doing business. But that gap is expensive. Every day you wait is a day you're either delaying decisions or making them based on gut feeling. Both options carry hidden costs that add up fast.

The good news? That three to six week wait is no longer necessary. Instant insights are changing how smart teams make decisions, and the shift is happening faster than most people realize.

The Real Cost of Waiting for Research

Think about the last time you needed customer feedback to make a big decision. Maybe you were testing a new product concept, changing your pricing, or trying to figure out which marketing message would land better with your audience.

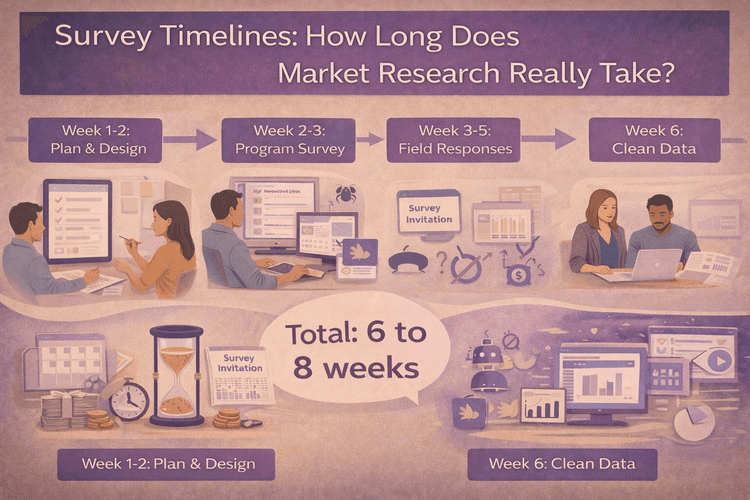

If you went the traditional route, you probably spent days designing the survey, more days recruiting the right people to take it, and then weeks waiting for enough responses to come in. After that, someone had to clean the data and put together a report. By the time you had actionable insights, the market conditions might have shifted.

Here's what really happens during those delays. Teams face a choice: wait for the data and risk missing the window, or move forward without it and hope for the best. Neither option is great. Delaying a product launch because you're waiting on research means your competitor might launch first. Moving forward without insights means you're betting on intuition, which works sometimes but fails expensively when it doesn't.

The traditional survey timeline forces teams into this uncomfortable position over and over again. Product launches happen on schedules. Seasonal campaigns have hard deadlines. Pricing changes need to happen before competitors make their moves. Consumer research, meanwhile, operates on a completely different timeline.

Why Fast Still Isn't Fast Enough

Even teams that have moved to online survey tools face bottlenecks. Sure, you're not mailing paper surveys anymore. But you still need to recruit people who match your target audience. You still need to wait for them to complete the survey. You still need enough responses to feel confident in the results.

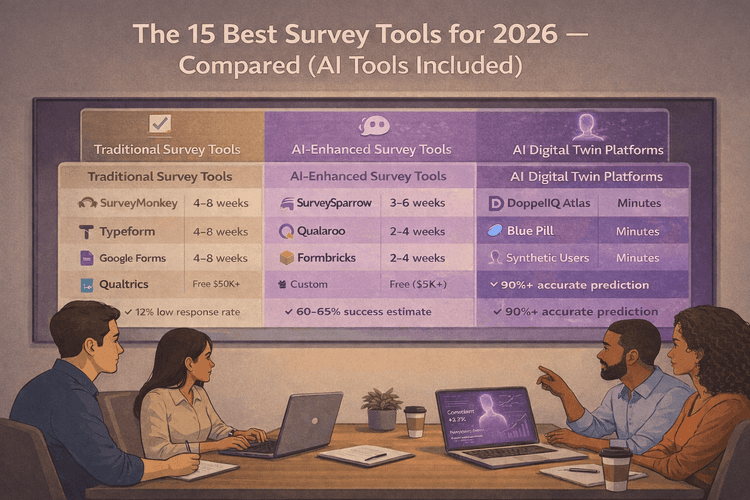

Here's how the timelines compare:

| Research Method | Time to Insights | Can You Adjust Questions? | Cost Per Study |

|---|---|---|---|

| Traditional Surveys | 3–6 weeks | No | High |

| Fast Online Surveys | 1–2 weeks | No | Medium |

| AI Digital Twins | Minutes | Yes | Low |

Survey response rates keep dropping, which means you need to reach even more people to hit your sample size goals. That takes time and money. Each response costs you something, whether you're paying a panel provider or offering incentives directly to participants.

Then there's survey fatigue. People are tired of surveys. They rush through them or give answers that don't reflect what they really think. Survey bias creeps into your data in ways that are hard to spot and even harder to fix. When survey costs keep rising and quality keeps dropping, something has to change.

The bigger issue is that traditional surveys lock you into one shot at getting it right. You design your questions, send them out, and hope you asked the right things. If you realize halfway through that you should have included a follow-up question or tested a different angle, it's too late. Starting over means another few weeks and more costs piling up.

What Instant Actually Means for Your Team

When we say instant insights, we're not talking about cutting corners or settling for less reliable data. We're talking about a completely different approach that makes exploration possible.

Imagine you could ask a question and get answers from thousands of consumers in minutes. Then, based on what you learn, ask a follow-up question. Test a different version of your concept. Compare three messaging options side by side. Run a what-if scenario to see how different audiences might react.

This is what instant enables. Instead of betting everything on one perfectly designed survey, you can test, learn, and refine your approach in real time. You can dig deeper when something interesting comes up. You can pivot when early results show you're headed in the wrong direction.

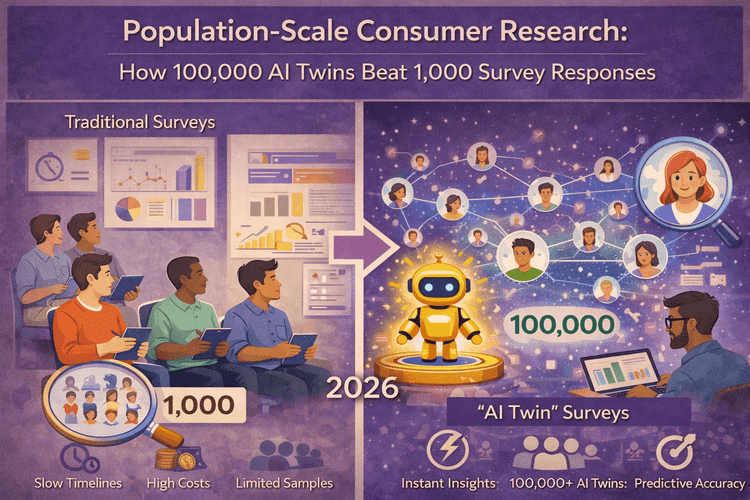

Speed doesn't mean shallow. When you can simulate responses from 100,000 consumers at once, you're actually getting more depth than most traditional surveys could ever provide. You're seeing patterns across different demographics, regions, and customer types simultaneously. You're testing edge cases without worrying about sample size.

The difference is like the gap between sending a letter and having a conversation. Letters require you to say everything upfront and hope you covered all the important points. Conversations let you adjust based on the responses you get.

How AI Digital Twins Changed the Game

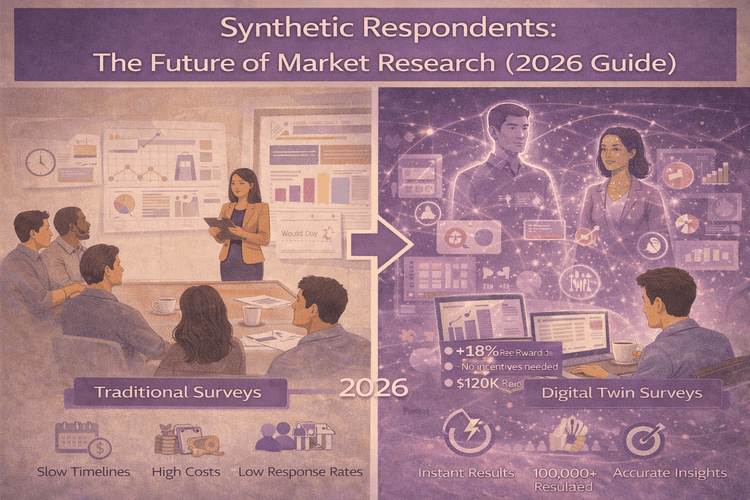

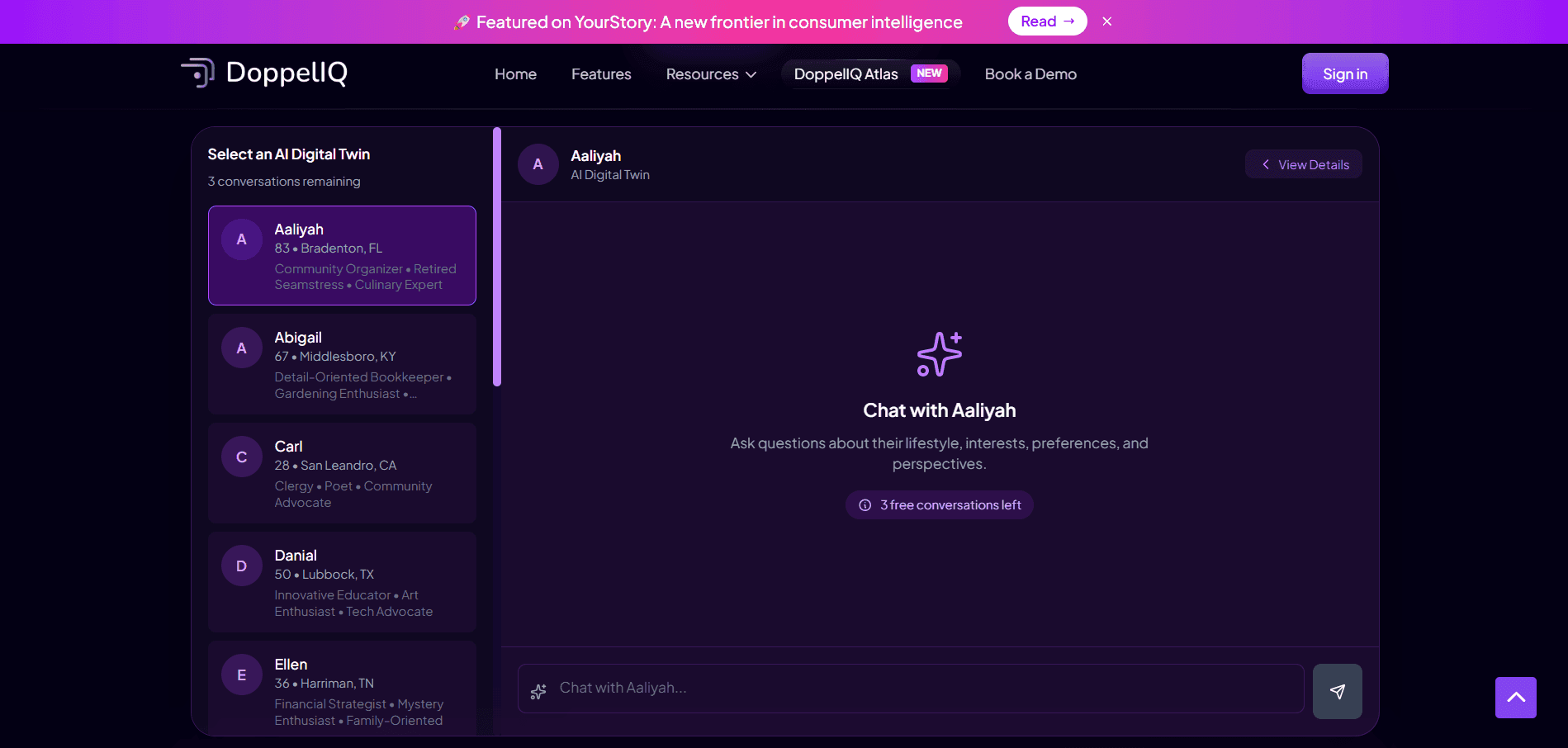

Here's where things get interesting. The reason instant insights are now possible comes down to AI digital twins. Think of them as virtual versions of real consumers, built using actual data about how people think, shop, and make decisions.

DoppelIQ Atlas is a pre-built population model that includes 100,000 representative US consumer profiles. These aren't made-up personas or generic customer types. They're synthetic respondents trained on national survey data, behavioral patterns, demographics, and psychographics. The system has about 91% correlation with real consumer survey results, which means the insights you get are genuinely reliable.

The biggest advantage? You don't need to provide any data to start using it. There's no setup period, no data integration, no technical configuration. You sign up, and you immediately have access to a nationwide panel ready to answer your questions.

You interact with Atlas using plain language. Just type your question like you're talking to a colleague: "How would you feel about this new product idea?" or "Which headline would resonate more with young professionals?" The system understands what you're asking and gives you structured insights based on how those consumer segments would actually respond.

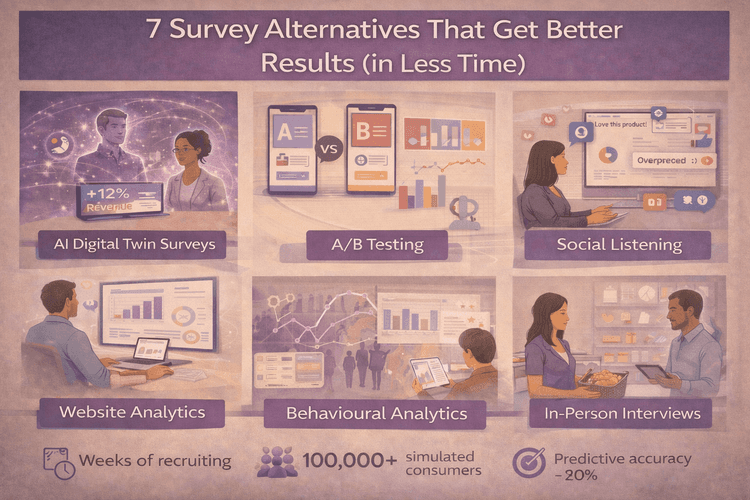

This approach solves all the bottlenecks that slow down traditional research. There's no recruitment phase because the consumer profiles already exist. There's no waiting for responses because the AI simulations run instantly. There's no survey fatigue or response bias because you're working with alternatives to traditional surveys that don't suffer from those problems.

Same-Day Decisions Become Normal

Let's talk about what this looks like in practice. Say you're planning a campaign and need to test three different messaging angles. You could design a survey, wait for responses, analyze the results, and have an answer in three weeks. Or you could ask Atlas right now, get insights in minutes, and start refining your campaign before lunch.

Teams use Atlas for campaign pre-testing all the time. They'll test headlines, compare value propositions, or see how different audiences react to the same message. Instead of spending ad budget to find out what works, they validate their approach first.

Product teams use it to prioritize features. Rather than guessing which capabilities matter most to customers, they can ask Atlas which features drive purchase intent among their target buyers. They get clarity on what to build first and what can wait.

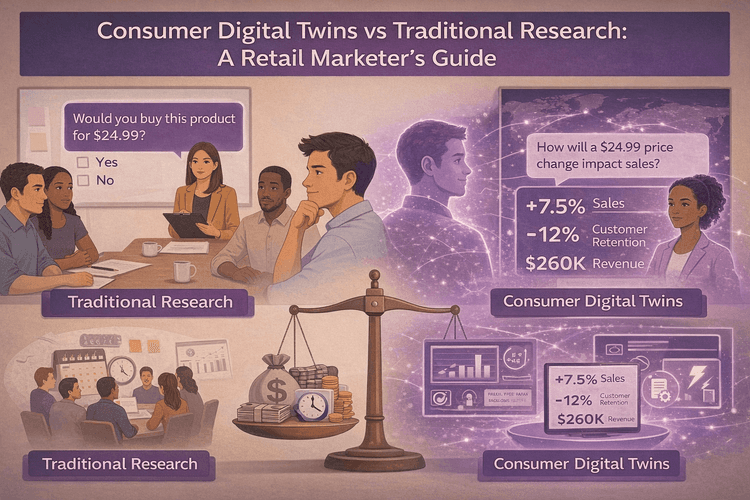

Pricing decisions that used to require extensive research now happen faster. You can test different price points across various customer segments and understand not just which price wins, but why certain groups react differently.

Market expansion becomes less risky. Before entering a new region or targeting a new demographic, you can simulate how that audience would respond to your offering. You can spot potential issues before they become expensive mistakes.

The pattern across all these use cases is the same. What used to require careful planning, significant budget, and weeks of waiting now happens in a single work session. Teams make confident decisions the same day they start asking questions.

Why Speed Creates Better Outcomes

Here's something that might not be obvious at first: faster insights don't just help you move quicker. They actually help you make smarter decisions.

When you can test multiple options in a day instead of running one survey over several weeks, you naturally explore more possibilities. You're not locked into your first idea because pivoting is easy. You ask tougher questions because getting answers doesn't require a new research project.

This creates a compounding advantage. Your team learns faster, which means you spot opportunities and avoid mistakes that competitors who are still waiting on survey results will miss. You refine your approach through iteration instead of hoping you got everything right on the first try.

Consumer research at population scale used to be something only big companies with huge research budgets could afford. Now teams of any size can access the same depth of insight, make decisions with the same confidence, and move at the same speed.

Comparing consumer research solutions shows that speed and accuracy no longer have to be trade-offs. The companies that figure this out first will have an edge. While others are designing surveys, you'll already have your answers. While they're waiting on data, you'll be in market testing your next iteration.

Frequently Asked Questions

How accurate are AI digital twins compared to real surveys?

DoppelIQ Atlas shows about 91% correlation with actual consumer survey results, which is reliable enough for most business decisions.

Do I need to provide customer data to use digital twins?

No. Atlas comes pre-built with 100,000 US consumer profiles, so you can start getting insights immediately without any data setup.

How much does instant consumer research cost?

Atlas offers free signup to get started, with costs far lower than traditional surveys that can run $3,000 to $10,000 per study.

Can I ask follow-up questions or change my research direction?

Yes. Unlike traditional surveys where you're locked into your questions, Atlas lets you explore, pivot, and dig deeper in real time.

What kind of questions can I ask AI digital twins?

Any question you'd ask in regular market research: product feedback, pricing reactions, messaging tests, feature priorities, and market fit.

How long does it take to get results?

Most teams get their first insights within minutes of asking a question, not the weeks traditional surveys require.

Do I need technical skills or data science support?

No. You interact with Atlas using normal conversational language, just like talking to a colleague.

Can small teams use this or is it only for big companies?

Any size team can use Atlas. The barrier to entry is much lower than traditional research that requires big budgets.

Try It Yourself

If you're tired of waiting weeks for consumer insights while decisions pile up, there's a straightforward solution. Sign up for DoppelIQ Atlas and see what instant insights feel like. The signup is free, and you can get your first results in minutes.

No technical setup. No data requirements. No complicated onboarding. Just ask your questions in plain language and get the insights you need to move forward with confidence. When the difference between good decisions and great ones comes down to how fast you can test your ideas, waiting is the real risk.

Related Articles

How beauty brands use digital customer twins to get insights and win in a competitive segment

Ankur Mandal

Ankur MandalCustomer digital twins vs focus groups vs ChatGPT: Concept testing in market research

Ankur Mandal

Ankur MandalPopulation-Scale Consumer Research: How 100,000 AI Twins Beat 1,000 Survey Responses

Nehan Mumtaz

Nehan MumtazDigital Twin Accuracy: Can AI Really Predict Consumer Behavior? (2026 Benchmark Data)

Nehan Mumtaz

Nehan MumtazConcept Testing Without Surveys: How AI Simulation Unlocks Your Full Product Potential

Nehan Mumtaz

Nehan Mumtaz