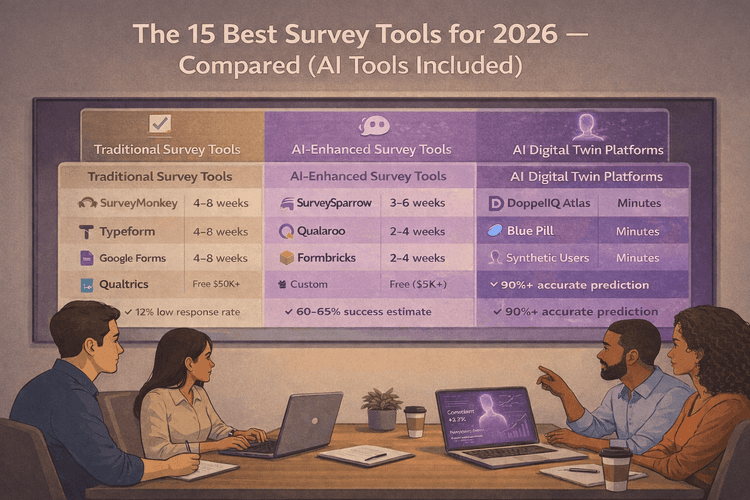

7 Survey Alternatives That Get Better Results (in Less Time)

Ankur Mandal

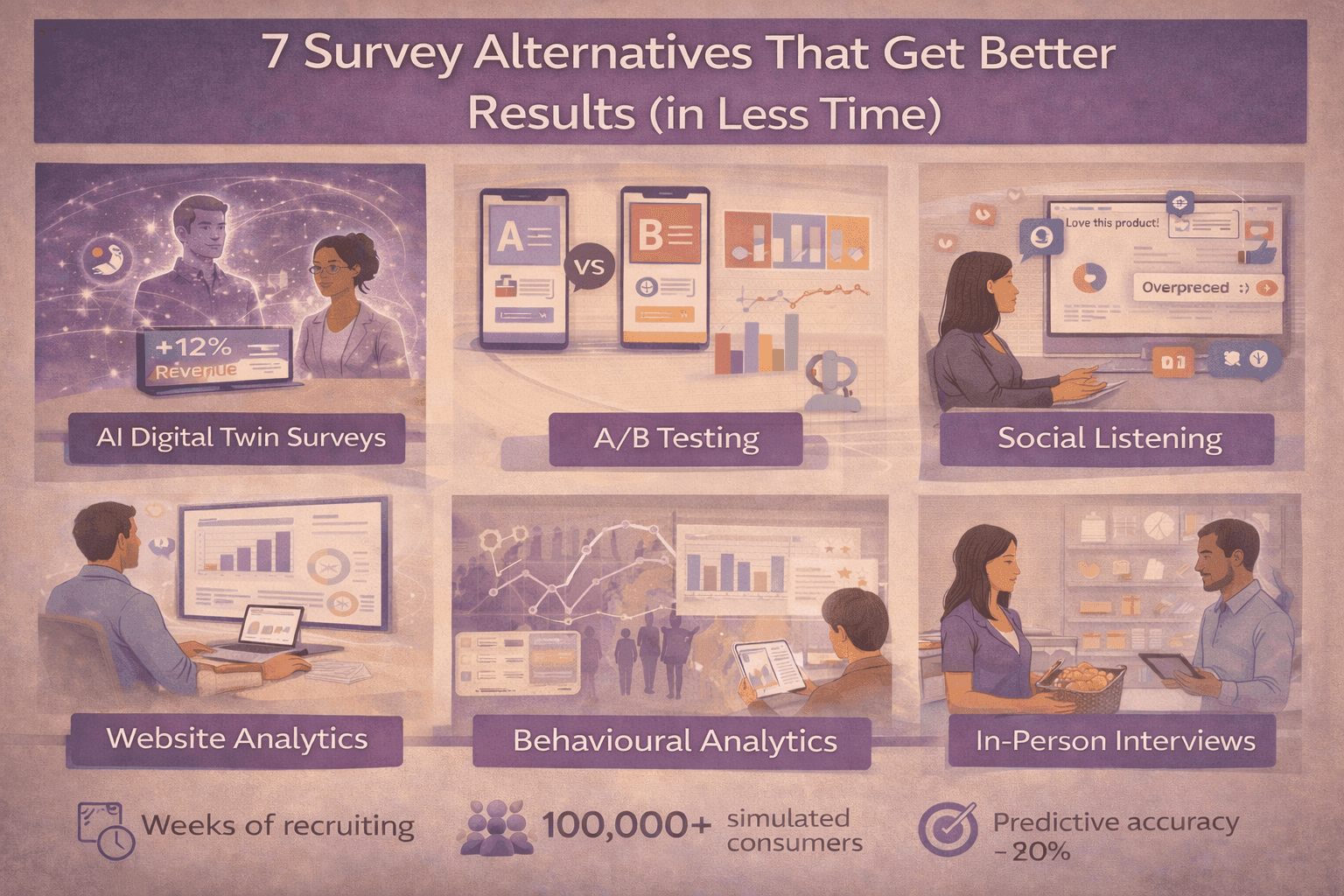

Ankur MandalRemember when you could send out a survey and actually get responses? Those days are fading fast. The average survey response rate is just 33% Xola, with email surveys often performing worse. That means if you email 1,000 customers, maybe 330 will bother responding. And those who do? They're probably rushing through it while waiting in line for coffee.

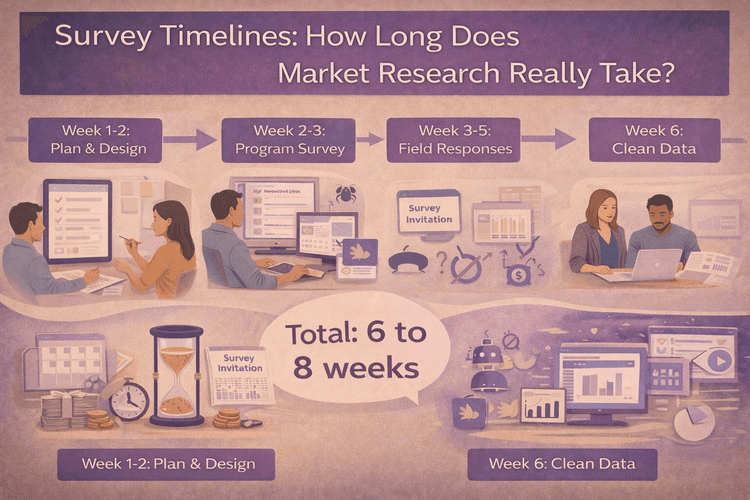

Traditional surveys take 2-4 weeks to complete, cost anywhere from $5 to $50 per respondent, and often leave you wondering if people are telling you what they really think or just what sounds good. There's a better way to understand your customers without waiting weeks or draining your research budget.

Here are seven alternatives that deliver faster insights, better engagement, and data you can actually use.

1. AI Consumer Digital Twins: Your Always-Available Focus Group

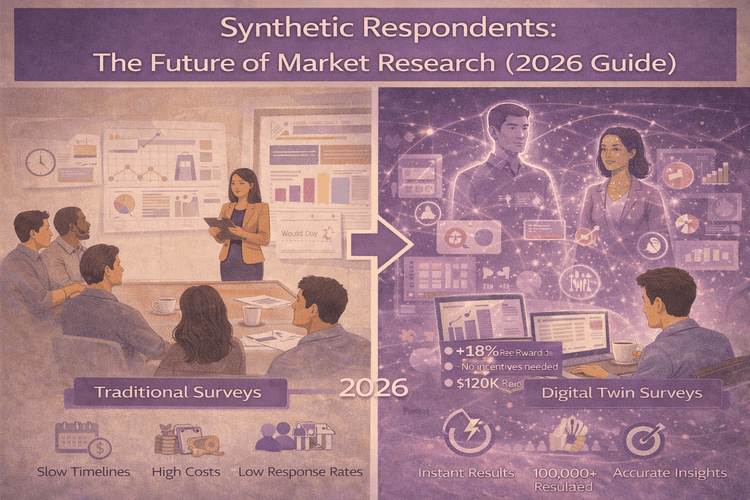

Imagine having a focus group of 100,000 people ready to answer your questions right now. No scheduling nightmares, no incentive costs, no waiting for responses. That's exactly what AI consumer digital twins deliver.

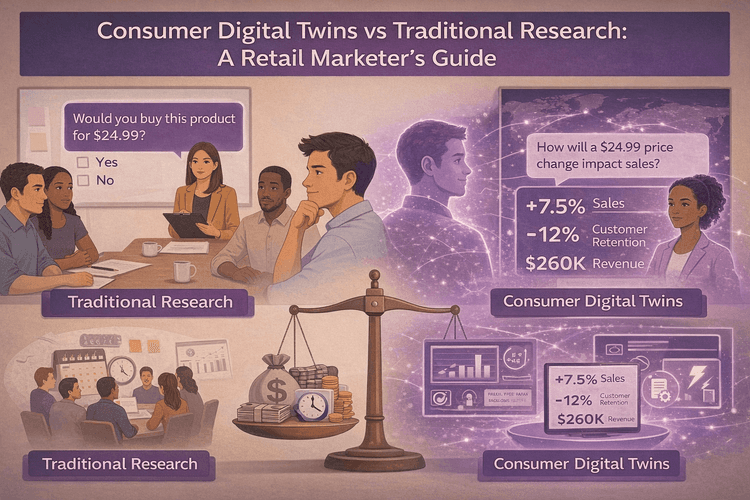

Think of it like this: instead of bothering real customers with yet another survey, you talk to behavioral simulations built from actual market data. These aren't made-up personas or generic AI responses. They're digital representations of real US consumers, modeled on national survey data, demographic distributions, purchasing behaviors, and psychographic patterns.

Here's how it works: platforms like DoppelIQ Atlas create behavioral simulations of 100,000 real US consumers based on actual market data, demographics, and buying patterns. You ask questions in plain English, and the digital twins respond based on how real people with their characteristics would actually behave.

How DoppelIQ Atlas works:

DoppelIQ Atlas gives you instant access to 100,000 pre-built digital twins representing the US consumer population. You don't need to upload any data, train any models, or hire data scientists. You simply sign up and start asking questions in plain English, just like you'd talk to a customer.

Want to know if suburban moms will pay $6.99 for your new protein bar? Ask them. Curious how Gen Z males feel about your rebrand? Get their take in minutes. Need to test 15 different taglines across multiple demographics? Run all the tests before lunch.

The platform gives you two research modes in one:

Twin Talk (Qualitative): Have natural conversations with digital twins. Ask follow-up questions, probe deeper into their reasoning, understand the "why" behind preferences. It's like conducting dozens of customer interviews simultaneously.

Twin Survey (Quantitative): Run structured surveys across thousands of twins in minutes. Get statistically significant sample sizes instantly, with the ability to filter by age, income, location, occupation, lifestyle, and aspirations.

Why this beats everything else:

No survey fatigue. Run 50 variations of your concept test if you want. The digital twins never get tired or annoyed. This means you can experiment freely without worrying about "saving" your real audience for the final version.

Instant results. Most teams get their first actionable insights within minutes of signing up. Compare that to traditional surveys where you're waiting 2-4 weeks just to hit your sample size.

Higher sample stability. Traditional qualitative research with 8-12 interviews can swing wildly based on who shows up. Small quantitative samples (under 200 people) have margin of error issues. Digital twins give you access to 100,000 profiles, eliminating the randomness.

Test before you spend. Use digital twins as your early warning system. Before you drop $50,000 on ad creative or commit to a new product line, get directional signals about what will resonate. Think of it as a safety net that catches expensive mistakes before they happen.

Real-world example:

A snack brand was debating between three product positioning strategies: "guilt-free indulgence," "energy boost," or "natural ingredients." Traditional research would have cost $15,000 and taken a month.

Using DoppelIQ Atlas, they tested all three messages across different demographics in 45 minutes. They discovered "energy boost" resonated strongest with their core audience of working professionals aged 25-45, but "natural ingredients" won with health-conscious parents. This insight led them to create two distinct marketing campaigns, dramatically improving their launch results.

Another retail brand used digital twins to simulate their entire customer journey, from awareness to purchase. They tested different touchpoints, messaging at each stage, and various offers. In two hours, they had a complete roadmap that would have taken weeks and cost tens of thousands with traditional research.

Best for:

-

Concept testing and validation before production

-

Pricing sensitivity analysis (finding your sweet spot)

-

Message testing across multiple audience segments

-

Offer optimization (free shipping vs. discount percentages)

-

Customer journey mapping and simulation

-

Competitive positioning research

-

Early-stage product development decisions

-

Campaign pre-testing before media spend

-

Market expansion research

The accuracy question:

DoppelIQ Atlas achieves 80% correlation with real US consumer survey outcomes. That's strong enough for directional decisions and hypothesis testing. Use it to narrow down your options from 10 ideas to 2, then validate with smaller real-world tests if needed.

The digital twins update annually based on fresh US survey benchmarks, so they stay current with evolving consumer behaviors and attitudes.

Getting started:

The platform is built for marketing teams, product managers, and strategists, not data scientists. No technical skills required. You literally type your question like you're texting a friend, and the system understands what you're asking. It even suggests ways to make your questions more precise and flags if you're missing important context.

Most teams use DoppelIQ Atlas in their regular workflow:

-

Monday morning: Test new campaign concepts with digital twins

-

Monday afternoon: Present results to team with data in hand

-

Tuesday: Refine winning concepts based on insights

-

Wednesday: Run final validation before production

Learn more about how digital twins revolutionize consumer research

Time to insights: Minutes Cost: Subscription-based with free signup available Sample size: 100,000 US consumer digital twins Accuracy: 83% correlation with real consumer surveys

2. User Interviews: Deep Conversations That Uncover the "Why"

Sometimes you need to understand not just what customers do, but why they do it. That's where one-on-one interviews shine.

User interviews are structured conversations where you talk directly with customers about their experiences, frustrations, and decision-making process. Unlike surveys with rigid multiple-choice questions, interviews let you dig deeper when something interesting comes up.

Best for:

-

Understanding complex purchase decisions

-

Discovering problems you didn't know existed

-

Getting stories and context behind behaviors

-

Early-stage product development when you're still figuring things out

The reality check:

Interviews are time-intensive. You need to recruit participants, schedule calls, conduct 30-60 minute conversations, and analyze the transcripts. Figure 2-4 weeks from start to finish, and budget $150-500 per interview depending on your audience.

Time to insights: 2-4 weeks Cost: $150-500 per interview

3. Behavioral Analytics: Watch What They Do, Not What They Say

Ever notice how people say they want healthy options but the cookie aisle is always empty? Actions speak louder than words, and behavioral analytics captures exactly what customers do on your website or app.

Tools like Google Analytics, Mixpanel, or Amplitude track every click, scroll, and purchase without asking customers to lift a finger. You see where people drop off in your checkout process, which products they browse but never buy, and how they actually navigate your site versus how you thought they would.

Best for:

-

Finding friction points in your customer journey

-

Understanding which features people actually use

-

Identifying where customers abandon their carts

-

Measuring engagement with new products or pages

The catch:

Behavioral data tells you what happened but not why. You'll see that 60% of people abandon checkout at the shipping page, but you won't know if it's because shipping costs are too high or the form is confusing. This is where combining behavioral data with digital twin simulations works brilliantly. Use analytics to spot the problem, then use digital twins to test different solutions.

Time to insights: Real-time Cost: Free to $500+/month

4. Social Listening: Eavesdrop on What Customers Really Think

Your customers are already talking about your brand, your competitors, and your product category on social media, review sites, and forums. Social listening tools like Brandwatch or Sprout Social help you tune into those conversations.

This is feedback you didn't have to ask for, which makes it incredibly honest. People complaining on Twitter about your competitor's customer service? That's intelligence you can use. Seeing emerging trends in how people talk about your product category? That's your early warning system.

Best for:

-

Monitoring brand perception

-

Competitive intelligence

-

Spotting emerging trends or problems

-

Crisis detection and management

Time to insights: Real-time Cost: $100-1,000+/month

5. Session Recordings and Heatmaps: Watch Your Website Through Customer Eyes

Tools like Hotjar, FullStory, or Microsoft Clarity record actual user sessions on your website. You can watch (anonymously) as real customers navigate your site, see where they hesitate, where they click on things that aren't clickable, and where they give up.

Heatmaps show you the hot zones where everyone clicks and the cold zones everyone ignores. It's like having X-ray vision for your website.

Best for:

-

Fixing confusing page layouts

-

Improving conversion rates

-

Identifying bugs or broken elements

-

Understanding mobile versus desktop behavior

Time to insights: Immediate (once you have traffic) Cost: Free to $200+/month

6. In-App Micro-Surveys: Quick Questions at the Right Moment

Instead of long surveys sent via email, micro-surveys pop up with one or two questions right when customers are experiencing something. Just finished a purchase? "How easy was checkout today?" Just viewed a product page? "Did you find what you were looking for?"

These get 20-40% response rates because they're quick, contextual, and catch people when the experience is fresh in their mind.

Best for:

-

Quick satisfaction checks

-

Understanding why people are leaving a page

-

Validating new features

-

Post-purchase feedback

Time to insights: Real-time Cost: $200-500+/month as part of product experience platforms

7. A/B Testing: Let Customer Behavior Cast the Vote

A/B testing is simple: show version A to half your customers and version B to the other half, then see which performs better. No opinions, no debates, just data on what actually works.

Testing whether a red or blue "Buy Now" button converts better? A/B test it. Wondering if free shipping or 10% off drives more sales? Test it. This method removes guesswork and politics from decisions.

Best for:

-

Optimizing conversion rates

-

Testing design changes

-

Comparing different offers or messages

-

Making data-driven decisions on contentious issues

Time to insights: 1-2 weeks for statistical significance Cost: Free to $1,000+/month

Which Alternative Should You Use?

Here's the simple breakdown:

Need speed and want to test multiple ideas? Start with DoppelIQ Atlas. Run your concepts through digital twin simulations before investing in anything else. Test 10 variations in the time it takes to schedule one focus group.

Need to understand complex motivations? Schedule user interviews for deep conversations.

Want to see what customers actually do? Turn on behavioral analytics and session recordings.

Need to know what people are saying about you? Set up social listening.

Want quick feedback on specific experiences? Use micro-surveys.

Trying to pick between two options? Run an A/B test.

Most successful teams use a layered approach. They start with digital twins to quickly validate multiple ideas and narrow their options. Then they might run a small A/B test with real customers to confirm the winner, or conduct a handful of user interviews to understand the deeper motivations.

For example: Test 8 product names with digital twins (1 hour), narrow to top 2 based on results, run A/B test with real traffic (1 week), launch winner. Total time: 8 days instead of 6 weeks.

Frequently Asked Questions

What are the best alternatives to traditional surveys?

AI digital twins, user interviews, behavioral analytics, social listening, session recordings, micro-surveys, and A/B testing all deliver faster, more actionable insights than traditional surveys.

Why are survey response rates so low?

People are overwhelmed with survey requests and typically don't have time to answer 15-20 questions, especially when there's no immediate benefit to them.

What's the fastest way to test a new product concept?

AI digital twins like DoppelIQ Atlas give you results in minutes by simulating responses from 100,000 consumer profiles without waiting for real people to respond.

Are AI digital twins accurate enough for marketing decisions?

Digital twins achieve 80% correlation with real consumer surveys, making them excellent for directional decisions and testing multiple concepts before investing in expensive research.

How much does traditional market research cost?

Traditional surveys cost $5-50 per respondent and take 2-4 weeks, while user interviews run $150-500 each, making them expensive for testing multiple ideas.

Can I use multiple research methods together?

Yes, the best approach is using fast methods like digital twins to test many ideas quickly, then validating top performers with A/B tests or interviews.

Do I need technical skills to use survey alternatives?

Most modern alternatives require no technical skills. Platforms like DoppelIQ Atlas use natural language, while tools like Hotjar have simple visual interfaces.

What's the difference between AI digital twins and AI personas?

Digital twins are built on real population data and behavioral patterns with 80% accuracy, while AI personas are generic profiles without grounding in actual market research.

How quickly can I get insights from digital twins?

Most teams get their first actionable insights within minutes of asking questions to digital twins, compared to 2-4 weeks with traditional surveys.

When should I still use traditional surveys?

Traditional surveys work best for final validation of major decisions, regulatory requirements, or when you need responses from your exact customer list rather than representative samples.

The Bottom Line

Traditional surveys aren't dead, but they shouldn't be your go-to research method in 2025. Response rates are dropping, customers are tired of 20-question surveys, and waiting three weeks for insights means your competitor might beat you to market.

The alternatives we've covered give you faster answers, better engagement, and often richer insights than traditional surveys ever could. The key is matching the method to what you need to learn.

Start with fast, inexpensive methods like AI digital twins to validate your hypotheses and test multiple directions. Then invest in more time-intensive methods for the ideas that show promise. This approach saves time, money, and keeps you moving at the speed your market demands.

Compare more consumer research solutions to find what works for your team.

Ready to Test Your Next Big Idea in Minutes?

Stop waiting weeks for survey results. Stop spending thousands on research that might tell you what you already know. Stop limiting yourself to testing just one or two ideas because traditional research is too expensive or time-consuming.

DoppelIQ Atlas gives you a smarter way forward.

Ask your research questions to 100,000 digital twins and get answers in minutes, not weeks. Test unlimited concepts, messages, and pricing strategies without survey fatigue or recruitment headaches. Run qualitative conversations and quantitative surveys on the same platform with just one click.

Whether you're testing a new product concept, optimizing your pricing, refining your messaging, or mapping out your customer journey, digital twins give you the directional insights you need to make confident decisions faster.

Sign up free and run your first research project today. No credit card required, no data science degree needed, no lengthy onboarding process. Just ask your questions like you're talking to a customer, and get insights faster than you ever thought possible.

The brands that move fast and test smart win. Start testing smarter today with DoppelIQ Atlas.

Related Articles

How beauty brands use digital customer twins to get insights and win in a competitive segment

Ankur Mandal

Ankur MandalCustomer digital twins vs focus groups vs ChatGPT: Concept testing in market research

Ankur Mandal

Ankur Mandal