The 15 Best Survey Tools for 2026 - Compared (AI Tools Included)

Ankur Mandal

Ankur MandalRemember when getting customer feedback meant mailing paper surveys and waiting weeks for responses? Those days are long gone. But here's the thing: even digital surveys are struggling. Response rates have crashed to an average of 33% across all channels in 2025, with email surveys hitting just 6-15%—down from 30% a decade ago. And by the time you collect enough responses (usually 4-8 weeks), your customers' preferences have already changed.

Welcome to 2026, where the survey landscape has split into three distinct paths. Think of it like choosing how to get somewhere: you can walk (traditional surveys), take a bus (AI-enhanced surveys), or teleport (AI digital twins). Each has its place, and we'll help you figure out which one fits your needs.

In this guide, we're breaking down 15 tools across all three categories. Whether you're a marketing manager testing a campaign, a product lead validating a concept, or a research director planning your 2026 strategy, you'll find exactly what you need here.

The Three Types of Survey Tools in 2026

Before we dive into specific tools, let's clear up the confusion. The survey world now has three distinct categories, and mixing them up is like confusing a calculator with a computer. They might look similar, but they work completely differently.

-

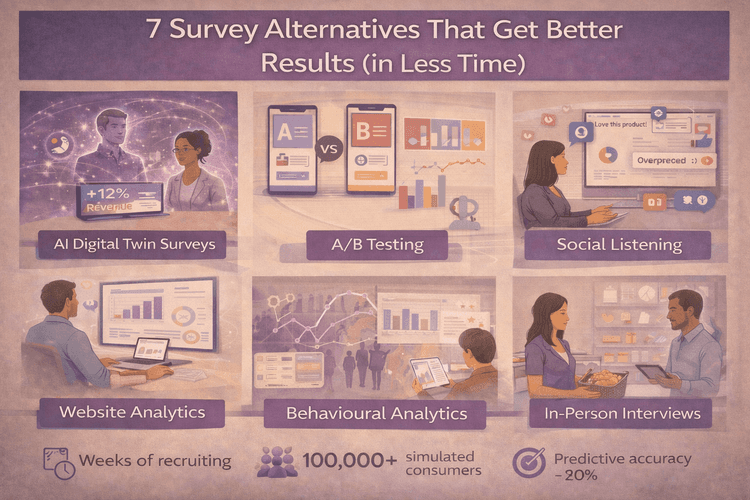

Traditional Survey Tools collect responses from real people. You create questions, send them out, and wait for humans to respond. Simple, right? The challenge is getting people to actually respond and waiting weeks for enough data.

-

AI-Enhanced Survey Tools are traditional tools with a smart assistant built in. They help you write better questions, analyze responses faster, and spot patterns you might miss. But you're still waiting for real people to respond.

-

AI Digital Twin Platforms are the new kids on the block. Instead of asking real people, you ask behaviorally accurate AI simulations of consumers. Think of it like having 100,000 customers available 24/7 to answer any question instantly. No waiting, no survey fatigue, no low response rates.

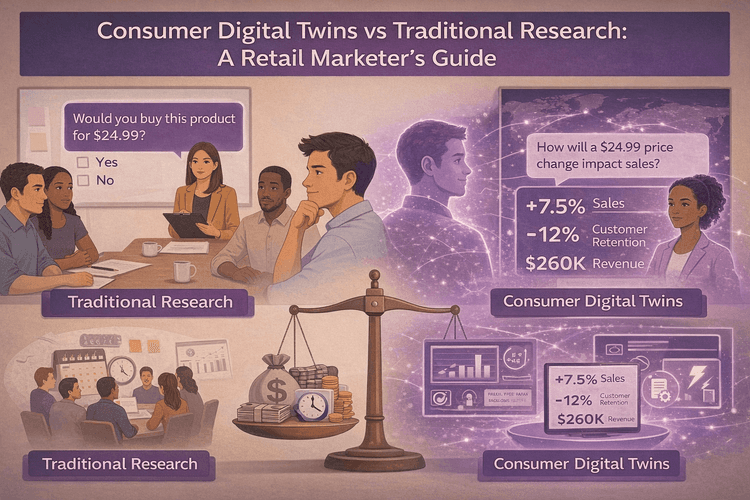

Here's the key difference: traditional and AI-enhanced tools measure what people say they'll do. Digital twins predict what people actually do. Research shows there's a 40-50% gap between the two, which is why your survey might say customers love a feature, but nobody uses it when you launch.

Complete Comparison: All 15 Tools at a Glance

Here's the full breakdown so you can compare everything side by side:

| Tool | Category | Best For | Speed to Results | Starting Price | Key Strength | Main Limitation |

|---|---|---|---|---|---|---|

| DoppelIQ Atlas | Digital Twin | Rapid testing, hypothesis validation | Minutes | Free, paid from $99/month | Access to100,000 consumer twins, unlimited studies | Annual updates (not real-time) |

| BluePill | Digital Twin | Product/packaging testing, high-confidence predictions | Minutes | Custom | 90%+ validation against live panels | Requires continuous benchmarking |

| Artificial Societies | Digital Twin | Social dynamics, viral prediction | Minutes | Accessible pricing | Simulates group interactions (500K personas) | Focuses on social influence |

| SurveyMonkey | Traditional | General purpose surveys | 4–8 weeks | Free, paid from $25/mo | Easy to use, templates | Low response rates (12%) |

| Typeform | Traditional | Customer-facing surveys | 4–8 weeks | Free, paid from $29/mo | Beautiful, conversational | Time-consuming to build |

| Google Forms | Traditional | Internal surveys, budget | 4–8 weeks | Free | Completely free, simple | Basic analysis only |

| Qualtrics | Traditional | Enterprise, academic | 4–8 weeks | Custom ($50K+) | Advanced features, compliance | Expensive, complex |

| Jotform | Traditional | Forms + surveys combo | 4–8 weeks | Free, paid from $34/mo | Payment integration | Jack of all trades |

| Alchemer | Traditional | Mid-market research | 4–8 weeks | $55–$165/mo | Advanced logic | Still traditional limitations |

| SurveySparrow | AI-Enhanced | Sentiment analysis | 3–6 weeks | $19–$499/mo | Auto sentiment detection | Still needs human responses |

| Qualaroo | AI-Enhanced | Website feedback | 2–4 weeks | $80–$300/mo | In-moment feedback | Website-specific only |

| Formbricks | AI-Enhanced | Developer teams | 2–4 weeks | Free (self-hosted) | Open-source, customizable | Technical setup required |

| Zigpoll | AI-Enhanced | Quick polls | 1–3 weeks | $25–$200/mo | Simple, fast setup | Limited to simple questions |

| Synthetic Users | Digital Twin | Qualitative research | Minutes | Custom | Focus group simulation | Primarily qualitative |

| Delve AI | Digital Twin | Small business personas | Minutes | $89–$299/mo | Affordable entry point | More AI persona than true twin |

Traditional Survey Tools: When You Need Real Human Voices

Let's start with the classics. These tools are like the reliable sedan in your garage. They're not flashy, but they work when you need direct human feedback.

1. SurveyMonkey

The household name in surveys. If surveys were search engines, SurveyMonkey would be Google.

Best for: General purpose surveys, quick polls, anyone who needs a survey right now

What you get: Hundreds of templates, every question type imaginable (multiple choice, ratings, open-ended), and analysis tools that turn responses into charts automatically. The interface is so simple your intern could build a survey in 10 minutes.

Pricing: Free plan for basic surveys. Paid plans run $25-$99/month depending on features.

The catch: You're still dealing with that 12% response rate problem. If you need 500 responses, you'll need to reach 4,000+ people.

Best use case: Quick employee feedback surveys, simple customer satisfaction polls, anything where authenticity matters more than speed.

2. Typeform

The pretty one. Typeform makes surveys feel like a conversation instead of homework.

Best for: Customer-facing surveys where you want high engagement, lead generation forms, anything public

What makes it different: One question appears at a time, like texting with a friend. This "conversational" approach gets better completion rates than traditional forms that show 50 questions at once.

Pricing: Free for basic surveys. Plans run $29-$99/month for more features.

Real talk: It's gorgeous, but building complex surveys takes longer than SurveyMonkey. Use this when appearance matters, like customer onboarding surveys or feedback forms on your website.

3. Google Forms

Free, simple, gets the job done. The Honda Civic of surveys.

Best for: Internal surveys, quick team polls, anyone on a tight budget

What you get: All the basics, automatic saving to Google Sheets, and zero learning curve. If you can use Gmail, you can use Google Forms.

Pricing: Completely free (or $12/user/month if you need Google Workspace features)

The limitation: Basic analysis only. You'll export to Excel for anything complex. But for "where should we have the team lunch?" it's perfect.

4. Qualtrics

The enterprise heavyweight. Think of this as the research platform universities and Fortune 500 companies use.

Best for: Academic research, large-scale market studies, anyone who needs "enterprise-grade" in their procurement docs

What sets it apart: Advanced logic, sophisticated analysis, can handle studies with 50,000+ respondents, meets compliance requirements for regulated industries.

Pricing: Custom enterprise pricing (usually $50K+ annually)

Reality check: Overkill for most teams. Unless you're running multi-country research studies or need academic-level rigor, simpler tools work fine.

5. Jotform

Started as a form builder, became a survey powerhouse.

Best for: Teams that need forms AND surveys, collecting payments with surveys, anyone juggling multiple tools

What's useful: 10,000+ templates, payment integration (collect money while surveying), connects to 100+ apps.

Pricing: Free tier available. Paid plans $34-$99/month.

Best use case: Event registration with surveys, order forms with feedback collection, multi-purpose teams.

6. Alchemer (formerly SurveyGizmo)

The middle ground between SurveyMonkey and Qualtrics.

Best for: Mid-size companies that outgrew SurveyMonkey but aren't ready for Qualtrics pricing

Key feature: Advanced logic without the enterprise price tag. If you need complex branching ("if they answer A, show question 5, if B, skip to question 12"), this handles it smoothly.

Pricing: $55-$165/month

When it makes sense: You're running serious research but not at enterprise scale.

The Traditional Tools Reality Check:

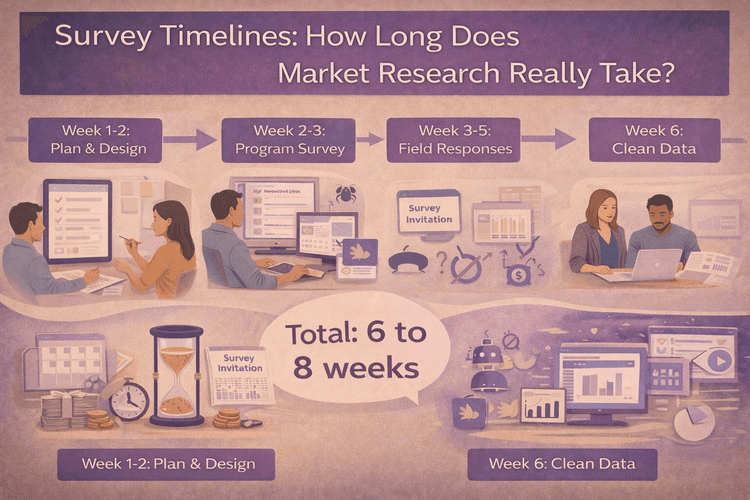

All these tools work. The question isn't quality, it's speed and cost. A typical 1,000-respondent study costs $25,000-$65,000 and takes 4-8 weeks. If you're running multiple studies per quarter, you're looking at $200,000+ annually. Plus, you're fighting that 12% response rate the whole time.

Traditional tools are perfect when you need authentic human voices for compliance, academic research, or situations where "we surveyed real customers" matters. But for rapid testing, hypothesis validation, or weekly decision-making? Keep reading.

AI-Enhanced Survey Tools: Traditional Surveys with Smart Features

These tools are like traditional surveys that went to grad school. They still collect human responses, but AI helps you work smarter.

7. SurveySparrow

Takes your survey responses and tells you how people feel, not just what they said.

Best for: Understanding customer sentiment, conversational surveys, teams tired of manually reading 500 open-ended responses

The AI part: Sentiment analysis that categorizes responses as positive, negative, or neutral automatically. Also suggests follow-up questions based on answers.

Pricing: $19-$499/month

Use it when: You're collecting lots of qualitative feedback and need to spot patterns fast.

8. Qualaroo

The website feedback specialist.

Best for: Getting feedback from people actively using your website or product

How it works: Pop-up surveys that appear at the right moment (like after someone spends 2 minutes on your pricing page). AI determines the best timing and targeting.

Pricing: $80-$300/month

Perfect for: E-commerce sites, SaaS products, anywhere you need in-the-moment feedback.

9. Formbricks

Open-source with AI analysis built in.

Best for: Tech teams, developers, anyone who wants to customize everything

The advantage: Free to self-host, AI helps analyze responses, developer-friendly.

Pricing: Free for self-hosted, or pay for managed hosting

Ideal user: Your engineering team wants survey capabilities built into your product.

10. Zigpoll

Quick polls with AI assistance.

Best for: Fast one-question polls, social media research, simple feedback

What AI does: Suggests question wording, helps interpret results, recommends follow-ups.

Pricing: $25-$200/month

Use case: Instagram story research, quick team decisions, simple customer polls.

AI-Enhanced Tools Reality:

These tools make your life easier, but they don't solve the core problem: you're still waiting for real people to respond. Response rates are still low. Timeline is still weeks, not minutes. Cost per project is still high.

Think of AI-enhanced tools as a faster horse. Digital twins? That's a car.

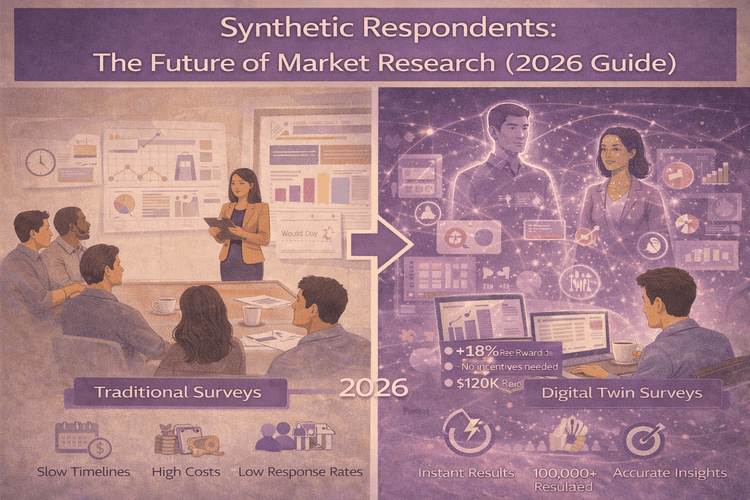

AI Digital Twin & Synthetic Respondent Platforms: The 2026 Revolution

Here's where things get interesting. Instead of asking 1,000 real people and getting 120 responses over 6 weeks, you ask 10,000 behaviorally accurate AI simulations and get results in 5 minutes.

I know what you're thinking: "Isn't that just making up data?"

Not even close. Here's the analogy: weather forecasts. Meteorologists don't wait for tomorrow to tell you if it'll rain. They run simulations based on historical patterns, current conditions, and atmospheric models. Modern weather forecasts are 80-90% accurate because the models are grounded in real data.

Digital twins work the same way. They're built on actual consumer data, validated against real outcomes, and predict behavior with 80-95% accuracy. The difference? Instead of predicting weather, they predict how consumers will respond to your campaign, product, or pricing.

Let's be crystal clear about one thing: AI digital twins are NOT the same as AI personas.

AI personas are made-up stereotypes. You know the type: "Marketing Mary, 35-44, loves yoga and organic coffee." They're based on assumptions, not behavior.

AI digital twins are individual simulations trained on real population data. Each twin has unique demographics, purchase patterns, and decision-making behaviors. It's the difference between a cartoon character and a flight simulator.

11. DoppelIQ Atlas ⭐ The Digital Twin Leader

If digital twin surveys are the future, DoppelIQ Atlas is the blueprint.

Here's what makes it different: you get instant access to 100,000 representative US consumer digital twins. Not personas. Not averages. Individual simulations of real consumers, each with unique demographics, psychographics, professional profiles, and media and lifestyle signals.

How it actually works:

Think of Atlas like having 100,000 customers permanently available for research. Need to know how suburban families feel about plant-based protein? Ask them. Want to test which headline resonates more with US consumers? Run the test in minutes. Wondering what unmet needs exist in the shoe market? They'll tell you exactly why they make the choices they do.

The system is pre-built and trained on national-level survey data, behavioral datasets, demographic distributions, psychographics, and category insights. It updates annually based on new US survey benchmarks to stay aligned with current consumer norms.

Here's the best part: you don't need ANY data to start. No customer lists, no purchase history, no setup. Just sign up and you're immediately talking to 100,000 US consumers.

Why retail marketers love it:

You know how you normally plan a campaign? You guess, maybe run a focus group ($15,000, 3 weeks), create the campaign, launch it, then discover your messaging missed the mark. By then, you've spent the budget.

With Atlas, you test everything before spending a dollar:

-

Message testing: Which headline resonates more with your target audience?

-

Concept testing: How would consumers respond to this new idea?

-

Feature prioritization: Which features matter most to US buyers?

-

Market positioning: How do different consumer types perceive your category?

-

Category pre-validation: Measure adoption potential across regions, demographics, or occupations before launch

-

Sentiment and bias mapping: Uncover hidden cultural or occupational biases that could affect acceptance

-

Campaign pre-flight: Test messaging on population segments before scaling ad spend

Real example: Instead of spending $50,000 on a campaign that flops, you test 20 variations on Atlas in one afternoon, pick the winner, and launch with confidence.

The speed advantage:

Traditional survey: "We need 1,000 responses. That's 6-8 weeks, $35,000."

DoppelIQ Atlas: "I'll run 10,000 respondents right now. Give me 5 minutes."

It's not an exaggeration. A large-scale 10,000-respondent study that traditionally takes 2 months happens in the time it takes you to make coffee.

Accuracy you can trust:

Atlas shows 83% correlation with real US consumer survey outcomes. That's the current benchmark, validated against actual survey data.

For comparison, traditional surveys have their own accuracy problems. People say they'll buy something, then don't (the famous 40-50% intention-action gap). Atlas predicts actual behavior, not just stated intentions.

- What is your intent to purchase Nike products in the next 6-12 months?

- Which product category is most relevant to you: Lifestyle, Basketball, Running, or Athleisure?

- Would young professionals pay more for sustainable coffee pods?

- What biases shape trust in \[your brand\] among retirees?

- What unmet need exists in the shoe market for you?

The system guides you in real-time, suggesting ways to make your questions more precise, flagging missing context, and ensuring your query targets the right consumer segments. You focus on the what and why you want to know. DoppelIQ handles the how.

Who should use Atlas:

-

Marketing teams testing campaigns without data science support

-

Insights teams tired of 12% response rates and 8-week timelines

-

Product teams validating concepts before development

-

Strategy teams exploring new markets or demographics

-

Anyone who needs to test hypotheses fast before committing a real budget

No technical expertise required. If you can have a normal conversation, you can use Atlas.

Getting started is instant:

Onboarding takes minutes. Sign up, gain access to the complete dataset of 100,000 digital twins, and most teams get their first insights within minutes. The platform is intuitive and the twins can be queried in natural language.

The money conversation:

Free signup to explore the platform. Annual plans run $50,000-$150,000 depending on your company size.

"Wait, that sounds expensive," you're thinking.

Compare it to traditional research:

-

Traditional: $200,000+ per year (4-6 studies at $35K-$50K each)

-

Atlas: $50K-$150K per year (unlimited studies)

Plus, traditional research is "use it or lose it." Each project is separate. Atlas? Run 500 tests if you want. No extra cost.

Most teams use Atlas for rapid hypothesis testing and campaign validation (saving 90% on research costs), then validate their final concepts with one or two traditional studies for stakeholder confidence.

Best first use case to prove value:

Start small with high-impact experiments that mirror real-world decisions:

-

Test which of two campaign messages performs better

-

Validate a product concept before development

-

Check pricing strategy across different demographics

-

Explore market entry opportunities

These produce insights within minutes. And because Atlas simulates behavior at an individual consumer level, you can pinpoint not just what works, but why, and adjust before spending on your product or campaign.

When NOT to use Atlas:

Be honest about limitations:

-

Academic peer-reviewed research (not yet widely accepted in journals)

-

Products so novel they have no market precedent

-

Situations where "we surveyed real customers" is legally required

-

Daily viral trend tracking (updates annually, not real-time)

Best practice: Use Atlas for hypothesis testing before committing budget to real-world studies. This approach gives you speed, saves money, and lets you validate the big bets with traditional research.

Start free with DoppelIQ Atlas →

Learn more about how digital twins work in our complete guide to instant consumer research.

12. BluePill

Builds AI consumers from millions of behavioral data points and continuously validates them against live human panels.

How it's different: BluePill benchmarks its AI consumers against real human panels with humans in the loop. Over 90% alignment with live responses means you're getting near-real predictions without waiting for real people.

Best for: CPG brands testing flavors and packaging, sports teams modeling fan behavior, companies wanting high-confidence predictions

Notable clients: Kettle & Fire (bone broth), Magic Spoon (cereal), Seattle Mariners (fan engagement)

Pricing: Custom (recently raised $6M in seed funding)

Use case: Testing which new cereal flavor will succeed before manufacturing, or predicting which stadium promotion will drive ticket sales.

13. Synthetic Users

Multi-agent interview platform.

The approach: Creates multiple AI agents that "discuss" your questions, simulating focus group dynamics.

Best for: Deep qualitative research, exploratory interviews

Pricing: Custom

When it fits: You need rich qualitative insights but don't have time for real focus groups.

14. Delve AI

Budget-friendly digital personas for smaller teams.

What you get: Generates personas from your website data and public sources, chat interface to "talk" with them.

Best for: Small businesses, startups, teams with limited research budgets

Pricing: $89-$299/month

Reality: More persona than true digital twin, but accessible pricing makes it a starting point.

15. Artificial Societies

Simulates entire groups of AI personas to predict how messages spread and audiences react collectively.

What makes it unique: Instead of isolated individuals, Artificial Societies shows how people influence each other in groups. It's built from 500,000 AI personas using individual-level data from LinkedIn and X.

Best for: Testing social media content before posting, predicting viral potential, understanding collective audience reactions

The platform: Generates 10 content variations automatically and shows 80% accuracy in predicting social performance (versus 62.5% for traditional AI).

Notable users: Anthropic, 11x, and 15,000+ creators who've run 100,000+ simulations

Pricing: Accessible to individual creators and businesses (raised €4.5M, Y Combinator-backed)

Use case: Simulate your LinkedIn audience to test posts before publishing, or simulate 1,000 investors to refine your pitch deck messaging.

How to Choose: The Practical Decision Guide

Let's make this simple. Here's how to pick based on your actual situation:

If you need compliance or academic credibility: Traditional tools (Qualtrics, SurveyMonkey)

If you're testing marketing campaigns weekly: Digital twins (DoppelIQ Atlas)

If you're validating a product concept: Digital twins first (minutes, cheap), then traditional validation (targeted, smaller sample)

If you need ongoing customer feedback: AI-enhanced tools (SurveySparrow, Qualaroo)

If you're exploring a new market: Digital twins (explore broadly), then traditional (validate specifically)

If budget is unlimited and time doesn't matter: Traditional tools work fine

If budget is tight and speed matters: Digital twins or free tools (Google Forms)

By company size:

-

Startups: Google Forms + DoppelIQ Atlas free trial

-

Mid-market: SurveyMonkey + DoppelIQ Atlas subscription

-

Enterprise: Qualtrics + DoppelIQ Atlas (hybrid strategy)

The Hybrid Approach (Most Teams Land Here):

-

Use DoppelIQ Atlas for hypothesis testing (90% of your research)

-

Validate final decisions with traditional surveys (10% of research)

-

Use AI-enhanced tools for ongoing feedback collection

This approach typically reduces research spending by 60-70% while actually improving decision quality because you test more options before committing.

Check out our comparison of consumer research solutions for deeper analysis of different platforms.

The Bottom Line: Survey Tools in 2026

The survey landscape has matured into three clear categories, each with distinct use cases.

Traditional tools aren't dead. They're essential when authenticity matters, when regulations require real human data, or when you need that "gold standard" validation for major decisions.

AI-enhanced tools make traditional surveys better. If you're already collecting human responses, these tools help you work smarter.

Digital twins are the breakthrough. When you need speed, when you're testing hypotheses, when you want to explore options before committing budget, platforms like DoppelIQ Atlas change everything. 80% accuracy in 5 minutes beats 100% accuracy in 8 weeks when you're making fast decisions in competitive markets.

Here's the future: successful teams won't choose one category. They'll use digital twins for exploration and testing (cheap, fast, unlimited), then validate their winners with traditional research (targeted, credible, expensive). This hybrid approach gives you the speed of AI with the credibility of human data.

The tools are ready. The methodology is proven. The question is: how long will you keep waiting weeks for insights you could have in minutes?

Frequently Asked Questions About Survey Tools in 2026

Q: What's the best free survey tool?

Google Forms for unlimited responses, SurveyMonkey free tier for 10 questions/40 responses, or DoppelIQ Atlas free signup for digital twin testing.

Q: How much should I budget for survey research in 2026?

Traditional approach costs $150,000-$200,000 annually for 4-6 studies. Hybrid approach (digital twins + validation) runs $50,000-$75,000 with 10x more insights.

Q: Can AI digital twins really replace traditional surveys?

Not completely. Use digital twins for hypothesis testing (90% of research), then validate critical decisions with traditional surveys (10%). This hybrid approach saves money while maintaining credibility.

Q: What's the difference between AI digital twins and AI personas?

AI personas are stereotypes based on assumptions. Digital twins are individual simulations trained on real population data that predict actual behavior with 80% accuracy.

Q: How do I know which survey tool is right for my team?

Need compliance? Traditional tools. Testing before launch? Digital twins. Ongoing customer feedback? AI-enhanced tools. Most teams use 2-3 tools for different purposes.

Q: What survey response rate should I expect in 2026?

Traditional surveys average 12% response rates. If you need 1,000 responses, plan to reach 8,000-10,000 people. Digital twins eliminate this problem entirely.

Q: Are digital twin surveys accurate enough for important business decisions?

Yes. Platforms show 80-95% correlation with real outcomes, often more accurate than traditional surveys (which have a 40-50% intention-action gap). Best practice: test with twins, validate winners traditionally.

Q: How long does it take to set up a digital twin survey platform?

DoppelIQ Atlas takes minutes with no data integration needed. Other platforms building custom twins from your data might take 2-4 weeks.

Q: What's the biggest mistake companies make with survey tools?

Running too few tests because traditional surveys are expensive and slow. Winners in 2026 test 20 campaign versions in an afternoon instead of launching one version blind.

Q: Can small businesses afford digital twin platforms?

Yes, some are surprisingly affordable. Delve AI starts at $89/month for basic personas. DoppelIQ Atlas now offers a Starter Plan at $99/month, designed for early teams that need fast, affordable consumer insights (including access to 100,000 synthetics users built on US population data and up to 200 simulated respondents per survey).

Q: Do I need a data scientist to use digital twin platforms?

No. DoppelIQ Atlas is built for marketing teams with natural language queries. No coding, no technical jargon, no PhD required.

Q: What happens if the digital twin predictions are wrong?

You adjust based on real results and rerun the test instantly. With 80% accuracy, 8 out of 10 predictions are correct, which beats launching blind.

Q: Should I stop using traditional surveys completely?

No. Use digital twins for 90% of exploratory research and testing, traditional surveys for 10% validation of critical decisions. You get speed, savings, AND credibility.

Q: How often should I run surveys?

Traditional tools: 2-6 studies per year due to cost. Digital twins: test weekly or daily since marginal cost is zero. Test everything that matters.

Q: What's coming next in survey technology?

Digital twin accuracy improving toward 90%+, seamless traditional-synthetic data integration, and hybrid approaches becoming standard practice within 2-3 years.

Ready to Experience Digital Twin Surveys?

Stop waiting weeks for survey responses. See what instant access to 100,000 behaviorally accurate consumer digital twins feels like.

DoppelIQ Atlas is free to try. No credit card, no lengthy setup, no waiting for respondents. Sign up, ask your first research question, and get results before your coffee gets cold.

Whether you're testing a campaign, validating a concept, or exploring a new market, you'll have answers in minutes instead of months. The marketing team that moves faster wins. Start moving faster today.

Start your free DoppelIQ Atlas trial now →

Questions about which tool fits your needs? Want to understand digital twins better? Check out our complete guide to consumer research platforms or dive into the science behind digital twins.

Related Articles

How beauty brands use digital customer twins to get insights and win in a competitive segment

Ankur Mandal

Ankur MandalCustomer digital twins vs focus groups vs ChatGPT: Concept testing in market research

Ankur Mandal

Ankur Mandal