Synthetic Respondents: The Future of Market Research (2026 Guide

Nehan Mumtaz

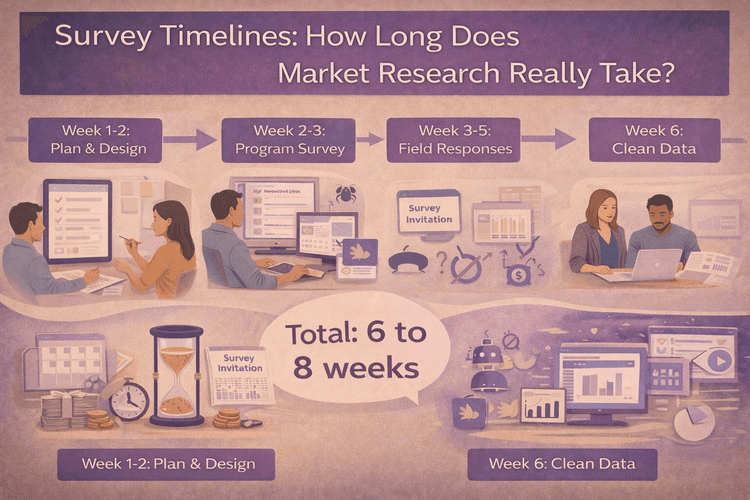

Nehan MumtazIf you've launched a survey in the past year, you've probably noticed something: people just aren't responding like they used to. Your 500-person target? You're lucky to get 150 completes. And those survey timelines? They keep stretching from two weeks to four, then six.

Welcome to 2026, where traditional market research is hitting a wall. But here's the good news: a new approach called synthetic respondents is changing everything about how we understand customers.

Think of synthetic respondents as the difference between test-driving one car and running a thousand crash test simulations. Both give you valuable information, but one lets you test more scenarios, faster, without the limitations of the physical world.

Why Traditional Surveys Are Breaking Down

Remember when you could send out a survey and actually get decent response rates? Those days are fading fast. Response rates have plummeted, and it's not hard to see why.

Your customers are drowning in survey requests. Every purchase, every service call, every app interaction triggers another "quick 5-minute survey" that actually takes 15 minutes. The result? Survey fatigue is real, and it's killing your data quality.

But the problems run deeper than fatigue:

Speed kills quality. Need insights fast? You'll settle for 200 responses instead of 1,000. Want a robust sample? Clear your calendar for the next month.

Costs keep climbing. A simple consumer survey now runs $5,000 to $15,000. Need a niche audience like "women who buy organic baby food and earn over $100K"? Double or triple that budget.

Bias creeps in everywhere. People tell you what sounds good, not what's true. They rush through questions. They misremember their own behavior. Professional survey-takers game the system for gift cards.

The real cost isn't just money. It's the product launch you delayed because insights came too late. It's the campaign you tested after it went live instead of before. It's the gut-feel decision you dressed up as "research-backed" because real research would take too long.

What Synthetic Respondents Actually Are

Here's where it gets interesting. Synthetic respondents aren't chatbots pretending to be customers. They're not some marketer's guess about how "Suburban Susan, age 35-44" might think.

Think of it like weather forecasting. Meteorologists don't send thousands of people outside to feel the temperature. They build models trained on decades of real weather data, then run simulations to predict what's coming. Those predictions aren't perfect, but they're accurate enough to help you decide whether to carry an umbrella.

Synthetic respondents work the same way. They're AI-powered simulations built on real consumer survey data, actual purchase behavior, demographic patterns, and lifestyle information. Instead of guessing how people might respond, they simulate responses based on how real people actually have responded to similar questions.

Synthetic Respondents 1.0 vs. 2.0: A Critical Difference

Not all synthetic respondents are created equal. This matters more than you might think.

| Feature |

Synthetic 1.0 (AI Personas) |

Synthetic 2.0 (Behavioral Simulations) |

|---|---|---|

| Data Source | Extrapolates from generic patterns rather than real user evidence | Real consumer survey data and behavioral patterns |

| Scale | 10–20 made-up personas | 100,000+ representative profiles |

| Accuracy | No validation | ~80% correlation with real surveys |

| Updates | Static, becomes outdated quickly | Annual recalibration with new data |

| Example | “Hey Gen Z consumer, pretend you’re a millennial” | DoppelIQ Atlas population model |

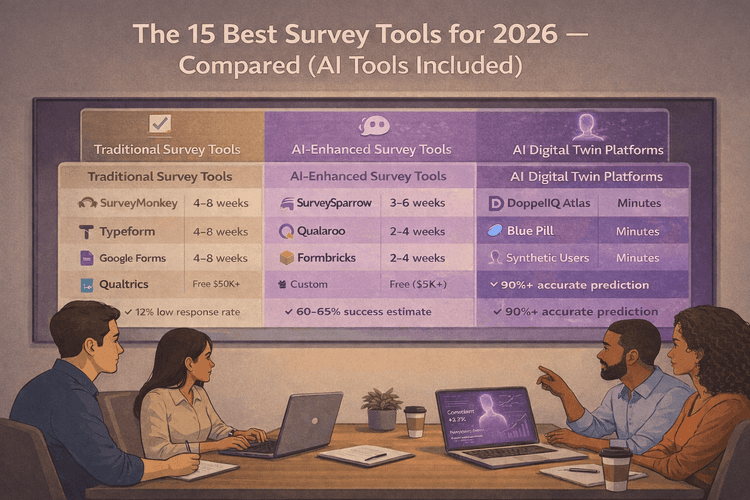

Version 1.0 is basically asking LLM models to roleplay as your target customer. "Pretend you're a millennial mom who shops at Target." It might sound convincing, but the outputs are inferred from broad heuristics, not grounded behavioral data

Version 2.0 is behaviorally grounded. Platforms like DoppelIQ Atlas train on real American Consumer Survey data, actual demographic distributions, and verified behavioral patterns. Instead of 10 made-up personas, you're querying 100,000+ statistically representative consumer profiles.

The difference? Version 1.0 gives you creative fiction. Version 2.0 gives you insights that correlate about 91% with real consumer survey results. That's accurate enough to test your holiday campaign messaging or validate whether your new product idea has legs.

When Synthetic Doesn't Mean Fake

The word "synthetic" makes people nervous. It sounds like artificial sweetener when you wanted real sugar.

But here's a better analogy: flight simulators. Pilots train on synthetic flight experiences, but those simulations are grounded in real physics, real weather patterns, and real aircraft specifications. A synthetic flight isn't a "fake" flight. It's a safe, repeatable way to practice scenarios that would be expensive or dangerous to test in real life.

Synthetic respondents work the same way. They're trained on:

-

Real survey responses from hundreds of thousands of Americans

-

Census-matched demographic distributions

-

Validated psychographic frameworks

-

Actual behavioral data from category purchases and lifestyle choices

The magic happens when you can query these profiles instantly. Want to know how "vegan Gen Z males working in tech" might react to your new protein bar? With traditional research, that's a nightmare to recruit. With a population-scale digital twin platform, it's a five-minute query.

Where Synthetic Respondents Beat Traditional Surveys

Let's talk about what synthetic respondents do better than human panels:

| Advantage | Traditional Surveys | Synthetic Respondents |

|---|---|---|

| Speed to Insights | 2–6 weeks | Minutes |

| Sample Size | 500–1,000 (typical) | 100,000+ profiles |

| Iteration Testing | 1–2 versions (budget-limited) | Test 10+ versions the same day |

| Niche Segments | Expensive and slow to recruit | Instant access to any segment |

| Cost per Study | $5,000–$25,000 | Fraction of traditional cost |

| Bias & Consistency | Social desirability bias, rushed answers, professional respondents | No reputation to protect, consistent responses |

| Survey Fatigue | Major issue affecting data quality | Non-existent |

Testing at the speed of thought. Remember waiting three weeks for survey results? Now imagine testing five different taglines in an hour, then refining the winner and testing three variations of that. That's the iteration advantage.

No sample size headaches. Need to understand how your product plays with "suburban moms making $75K-100K who care about sustainability"? That's maybe 50 people in a typical 1,000-person survey. With synthetic respondents, you can query exactly that segment at scale.

Consistency you can count on. Real people have bad days. They misread questions. They rush through surveys on their phone while watching TV. And here's what else happens with traditional surveys:

-

Social desirability bias: People tell you they'll buy organic vegetables when they really grab whatever's cheap and convenient.

-

Acquiescence bias: Some respondents just agree with everything to finish faster, saying "yes" even when they mean "no."

-

Recency bias: Ask about shopping habits, and people only remember their last trip, forgetting their actual patterns.

-

Professional respondents: Some people take surveys for gift cards full-time, learning to game the system for maximum rewards.

Synthetic respondents eliminate these issues. They have no reputation to protect, no gift card to chase, and no bad Monday morning affecting their answers. You get clean, consistent data every single time. Want to learn more about how bias affects your data? Check out our guide on 7 types of survey bias that ruin your data.

Budget that makes sense. A traditional 1,000-person survey might cost $10,000 and take a month. The synthetic equivalent? A fraction of the cost, delivered in minutes. This isn't about being cheap. It's about running ten tests instead of one.

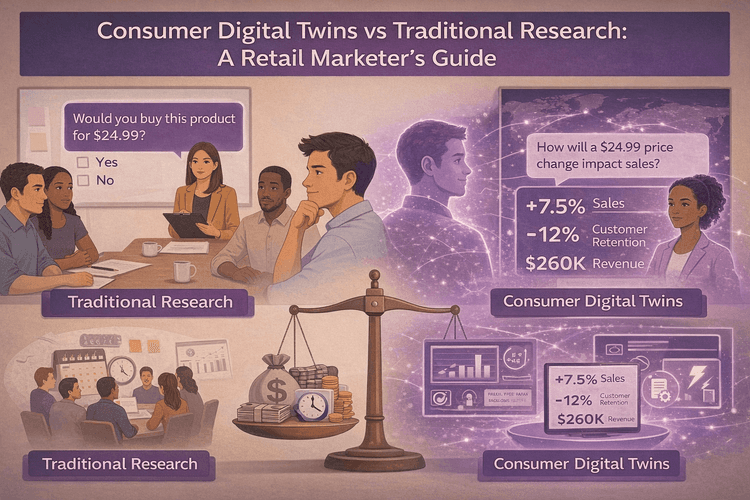

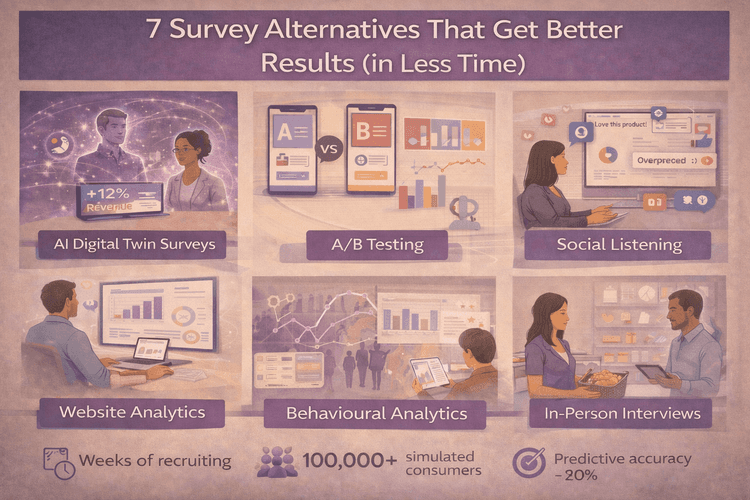

Looking for other approaches? Check out these survey alternatives that get better results or explore the best consumer research solutions for 2025.

Where Humans Still Win

Before you cancel all your traditional research, hold on. Synthetic respondents aren't replacing humans. They're handling the heavy lifting so humans can do what they do best.

Deep conversations still need real people. If you're exploring entirely new territory like "how might climate anxiety affect luxury purchases in 2030," you need real humans thinking out loud, making connections you didn't expect.

Cultural moments require lived experience. When something breaks in the news or culture shifts overnight, you need real people processing real emotions in real time.

The spark of discovery is human. Those lightbulb moments in focus groups, when someone says something that reframes your entire strategy? That's still a human superpower.

Think of it like cooking. Synthetic respondents are your Instant Pot. They handle the everyday meals quickly and consistently. But for that special dinner party when you need creativity and intuition? You're still cooking from scratch.

How to Start Using Synthetic Respondents Today

The best part? You don't need a data science team or a six-figure budget to try this.

Platforms like DoppelIQ Atlas offer free signups with immediate access to 100,000+ consumer profiles. You ask questions in plain English, just like you would in a normal survey. "Which of these three product names do millennial parents prefer?" The platform handles the rest.

Start small. Pick one question you'd normally send to a survey panel. Maybe it's testing two email subject lines or validating whether a product feature matters. Run it through synthetic respondents first. See how the insights compare to your intuition or past research.

The goal isn't to replace your entire research program overnight. It's to add a new tool that makes you faster and smarter.

Test campaign messages before you spend the media budget. Validate product concepts before you brief the agency. Explore ten positioning options instead of two. Use synthetic respondents for breadth and speed, then bring in human research for depth on the ideas that show promise.

The Bottom Line for 2026

Market research in 2026 isn't about choosing between synthetic and human respondents. It's about using each where they're strongest.

Use synthetic respondents when you need speed, scale, and iteration. Use human research when you need depth, discovery, and cultural nuance. Most importantly, stop letting research timelines and budgets make your decisions for you.

The brands winning in 2026 aren't the ones with the biggest research budgets. They're the ones moving fastest from question to insight to action. Synthetic respondents make that possible.

Frequently Asked Questions About Synthetic Respondents

How accurate are synthetic respondents compared to real surveys?

Behaviorally grounded synthetic respondents show about 91% correlation with real consumer survey outcomes, which is accurate enough for most marketing decisions like message testing and concept validation.

Do I need to provide my customer data to use synthetic respondents?

No, platforms like DoppelIQ Atlas come pre-built with 100,000+ representative profiles, so you just sign up and start asking questions without sharing any data.

Can synthetic respondents replace my entire research budget?

No, they're best used for quick testing and iteration, while traditional research is still needed for deep qualitative exploration and validating major strategic decisions.

What types of questions work best with synthetic respondents?

They excel at quantitative survey questions like "which headline resonates more?" or "how likely are you to purchase?" but work less well for open-ended exploratory questions.

How long does it take to get results?

You get insights within minutes, compared to traditional surveys that take 2-6 weeks from design to data.

What if I need to survey a very specific niche audience?

Synthetic respondents excel here because you can filter down to highly specific segments that would be nearly impossible or expensive to recruit in traditional research.

Are synthetic respondents just AI personas or chatbots?

No, version 2.0 synthetic respondents are trained on real consumer survey data and behavioral patterns, not generic stereotypes like basic AI chatbots.

Do I need technical skills or data science knowledge to use this?

No, you ask questions in plain conversational English just like writing a regular survey, and the platform guides you through the process.

How much does it cost compared to traditional surveys?

Traditional surveys cost $5,000 to $25,000+ while synthetic respondent platforms typically cost a fraction of that with free tiers or affordable subscriptions.

Can I use synthetic respondents for B2B research?

Platforms like DoppelIQ Atlas focus on US consumer populations for B2C research, so they work best for consumer brands rather than specialized B2B audiences.

How often are the synthetic respondent profiles updated?

Quality platforms update their models annually based on new survey benchmarks and demographic shifts to stay aligned with current consumer behaviors.

What's the biggest mistake people make when starting with synthetic respondents?

Expecting 100% perfect accuracy instead of using them as directional tools to narrow down options quickly, then validating finalists with traditional research for high-stakes decisions.

Ready to Try Synthetic Respondents?

Sign up for DoppelIQ Atlas free and get your first insights in minutes. No credit card required. No data science degree needed. Just ask your questions in plain English and see what 100,000+ AI consumer digital twins tell you.

The future of market research isn't coming. It's already here. The only question is whether you'll be early or late to use it.

Related Articles

How beauty brands use digital customer twins to get insights and win in a competitive segment

Ankur Mandal

Ankur MandalCustomer digital twins vs focus groups vs ChatGPT: Concept testing in market research

Ankur Mandal

Ankur Mandal